Survival of the Richest

Europe’s role in supporting an unjust global tax system 2016

There is a sharp rise in secret ‘sweetheart tax deals’ with multinational corporations, states the latest Eurodad-report. These, and other, findings are published in ‘Survival of the Richest: Europe’s role in supporting an unjust global tax system 2016’, the fourth annual report by Eurodad, examining the tax and transparency policies of the European institutions, 17 Member States and Norway.

The report finds that:

• Since the LuxLeaks scandal, the amount of secret ‘sweetheart deals’ between multinational corporations and European governments has increased by almost 50%;

• Mapping of government positions show political support for transparency has grown, but challenges remain;

• European governments continue to sign controversial tax treaties that undermine taxation in developing countries;

• Among the 18 countries analysed in the report, not a single government is supporting the establishment of a new UN tax body, which would give developing countries a seat at the table when global tax standards are negotiated.

Secret ‘sweetheart deals’ in the EU have soared, according to a new report. Incredibly, after the LuxLeaks scandal the amount of deals kept increasing dramatically, from 547 in 2013 to 972 in 2014, finally reaching 1444 by the end of 2015. According to the report’s analysis of new European Commission data, that is an increase of 160 per cent in just two years.

As these deals are secret to the public, the content of these agreements is unknown. However, the LuxLeaks scandal and several ongoing state aid cases have shown that these deals can create the basis for large scale corporate tax dodging in both developed and developing countries. Belgium and – incredibly – Luxembourg have made the greatest number of new sweetheart deals with multinational corporations.

The report authors, a coalition of civil society organisations across Europe, have made a comparative analysis of 18 European countries. They also found that:

– Support for transparency around the true owners of businesses is growing and, among the 18 European countries covered by the report, the group of countries in favour of transparency is now – for the first time – larger than the group against.

– There is also growing support for transparency around what multinational corporations are actually paying in taxes in the countries where they operate. However, the governments that are against this measure still outnumber supporters.

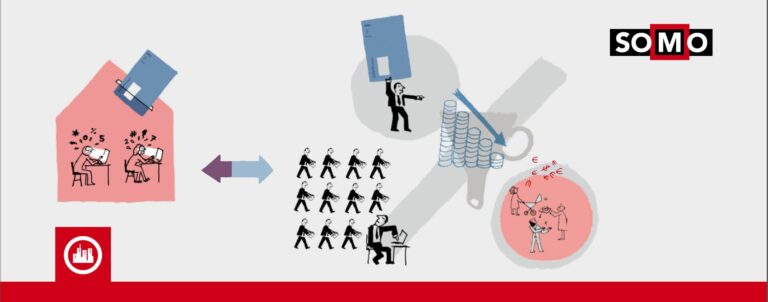

– European governments keep signing controversial tax treaties, which undermine taxation in developing countries. In total, the countries covered in the report has 752 such treaties. On average, these treaties lower tax rates in developing countries by 3.8 percentage points.

– More than half of the governments investigated remain opposed to the idea of giving developing countries a seat at the table when global tax standards are negotiated. Not one single government is actively speaking out in favour of this proposal.

Tove Maria Ryding said: “It’s very surprising and deeply worrying to see that the amount of secret sweetheart deals is skyrocketing in Europe – as if the LuxLeaks scandal never happened. We know from examples like the Apple case and LuxLeaks that these secret deals can be used for large scale tax avoidance by multinational corporations. And as we can see with the LuxLeaks trial, anyone who tells the public what’s in these deals can get threatened with lawsuits and jail time. The fact that multinational corporations now have more than one thousand sweetheart deals in Europe is deeply concerning, to say the least.”

Do you need more information?

-

Jasper van Teeffelen

Researcher

Partners

Publication

-

Download: Survival of the richest. Europe’s role in supporting an unjust global tax system 2016 (pdf, 2.95 MB)

Related content

-

Sharp rise in secret ‘sweetheart tax deals’ with multinational corporationsPosted in category:NewsPublished on:

Sharp rise in secret ‘sweetheart tax deals’ with multinational corporationsPosted in category:NewsPublished on: -

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

Giving with one hand and taking with the other Published on:

Roos van OsPosted in category:Publication

Roos van OsPosted in category:Publication Roos van Os

Roos van Os -

Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodgingPosted in category:NewsPublished on:

Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodgingPosted in category:NewsPublished on: -

-

-

A year after Luxleaks, most EU countries still fail to tackle tax dodgingPosted in category:NewsPublished on:

A year after Luxleaks, most EU countries still fail to tackle tax dodgingPosted in category:NewsPublished on: -

Avoiding Tax in Times of Austerity Published on:

Katrin McGauranPosted in category:Publication

Katrin McGauranPosted in category:Publication Katrin McGauran

Katrin McGauran

-

-

Dutch double taxation treaties lead to huge revenue losses in developing countriesPosted in category:NewsPublished on:

Dutch double taxation treaties lead to huge revenue losses in developing countriesPosted in category:NewsPublished on: