Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodging

European leaders should use their meeting this week to agree further action against tax dodging by multinationals, CSOs urge in a new report.

The new report: ‘Giving with one hand and taking with the other: Europe’s role in tax-related capital flight from developing countries 2013’ reveals the state of money laundering, tax avoidance and tax evasion, and the extent of government action against them, across 13 EU Countries.

At the European level, the report – coordinated by the European Network on Debt and Development (Eurodad) – shows that much remains to be done. Tove Maria Ryding, Tax Coordinator at Eurodad, said: ‘This week, we’re asking EU leaders to take the first step by making companies reveal to the public who their owners are, where they operate and what taxes they pay.

‘The second step is to ensure that the multinational companies pay their fair share of tax, both in the EU and in the rest of the world.”

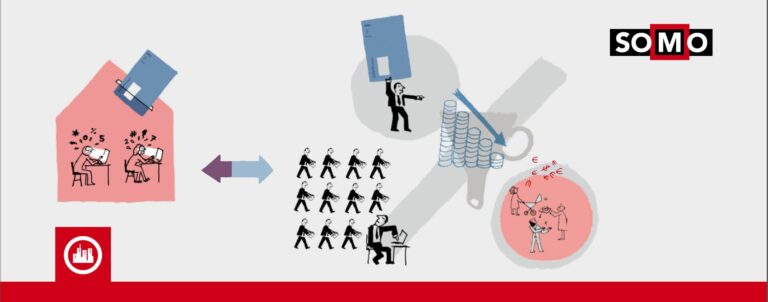

She added: “For developing countries, tax dodging is especially devastating, with more money leaving their economies than what they receive in aid. While European citizens donate money to combat poverty in developing countries, multinational corporations with headquarters in Europe are making large profits in those same countries but many are avoiding their taxes. Until our governments put a stop to this, Europe is giving with one hand and taking with the other.”

The report concludes that:

• All governments surveyed are failing to demand adequate tax transparency from companies, in that no government has implemented full country-by-country reporting.

• Most governments are reluctant to let members of the public find out who really owns the companies, trusts and foundations within their jurisdictions.

• Data showing governments’ exchange of tax-related information are rarely publicly accessible and countries in the global South are barely participating in this form of exchange, which could help them identify tax evaders.

• No European governments support equal inclusion of developing countries in policy making on tax and transparency.

Eurodad

Eurodad (the European Network on Debt and Development)(opens in new window)

is a network of 48 non-governmental organisations from 19 European countries working on issues related to debt, development finance and poverty reduction. Since it was founded in 1989, Eurodad has been pushing for development policies that support pro-poor and democratically-defined sustainable development strategies. Eurodad works on the promotion of responsible finance principles. See Eurodad’s responsible finance charter(opens in new window)

.

Do you need more information?

-

Jasper van Teeffelen

Researcher

Partners

Related content

-

-

Avoiding Tax in Times of Austerity Published on:

Katrin McGauranPosted in category:Publication

Katrin McGauranPosted in category:Publication Katrin McGauran

Katrin McGauran

-

Dutch tax facilities for group financing Published on:F. WeyzigPosted in category:PublicationF. Weyzig

-

-