Monopoly market power and rent extraction

Over several decades, the rise of financial globalisation and neoliberal policies have created a favourable environment for monopolies and rent extraction. This has become evident through the significant augmentation of market power among the world’s largest corporations, which is visible through increasing revenue, market capitalisation, and asset ownership.

Our work at SOMO focuses on dismantling some of the main enablers of monopoly power and rent extraction structures, which allow people to generate huge profits from existing assets.

‘Monopoly’ refers to a situation in which a single entity or a group of entities have exclusive control over a particular market or industry. A company that has created a monopoly will naturally reinforce its position to increase its advantage. If left unchecked, companies with monopoly market power negatively affect labour rights and increase inequality in wage shares.

A company that has a market power can generate income through the ownership or control of a scarce good, also called rent extraction or ‘rentier power’. For example, both governments and extractive companies generate rents from their ownership and control over oil and minerals.

Another recent and challenging example is the extraction of rents by Big Tech companies through their ownership of platforms, or the rentier power of big pharmaceutical companies through patents and drug pricing.

Highlighted Publications

-

Hungry for profits Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink

-

How tech billionaires are killing internet for all Published on:

Margarida SilvaPosted in category:Publication

Margarida SilvaPosted in category:Publication Margarida Silva

Margarida Silva

-

Taken, not earned Published on:

Margarida SilvaPosted in category:Publication

Margarida SilvaPosted in category:Publication Margarida Silva

Margarida Silva

Reining in monopoly market power in the Big Tech industry

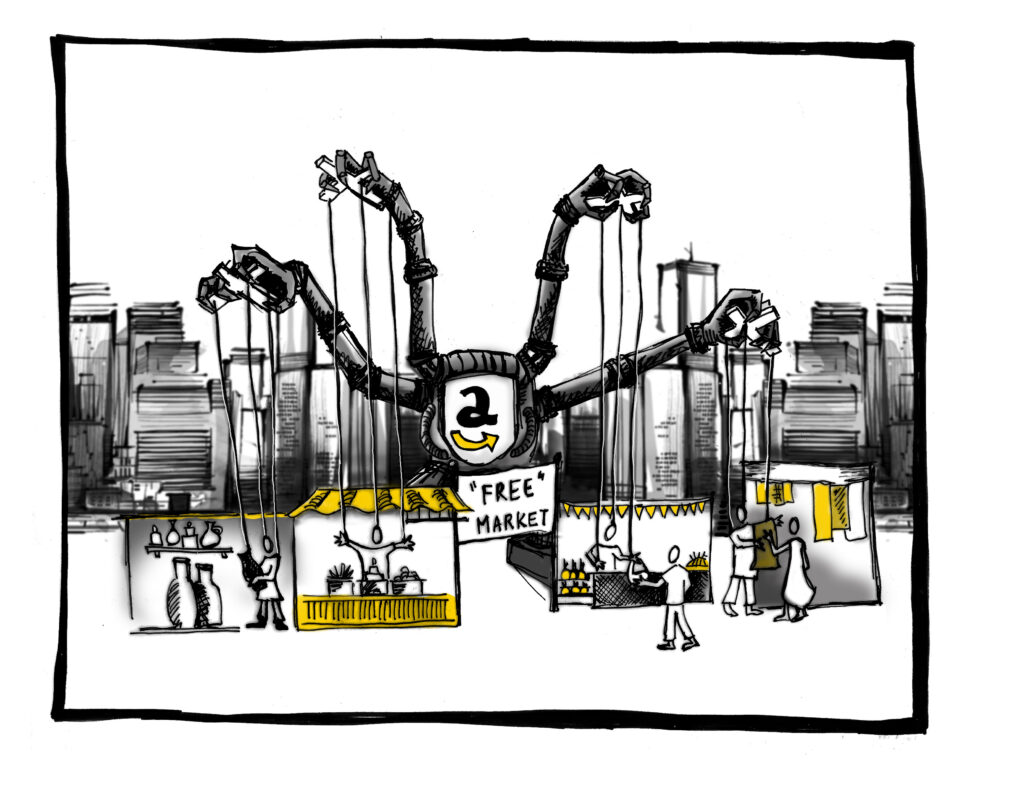

As Big Tech platforms become increasingly omnipresent, users are becoming more dependent on them, as there is less choice in the market. This allows the platforms to acquire vast amounts of data. Over time, their ability to amass so much data gives them a massive advantage over competitors. It enables them to predict which products and services are on the rise and to acquire new products or companies, buying them from potential competitors. This secures the company’s market dominance, feeding them more data, and providing them with a launch pad to further expand.

Creating a digital monopoly allows companies to profit through rent extraction. Owning or controlling scarce assets such as data with little competition will enable them to generate rent-like income.

They impact the economy as a whole, the way people do business, their rights as employees and consumers, and the choices they can exercise. It is already abundantly clear that the monopoly power of Big Tech needs to be reined in. In the short term, this means more significant limits, more control on mergers and acquisitions, and stronger protections for workers and smaller companies that become dependent on the platforms.

However, there is also a need for a more ambitious long-term vision of how Europe addresses Big Tech’s digital monopolies.

Challenging Big Tech

Big Tech companies have become omnipresent in people’s lives and in the global economy. Their monopoly power needs to be broken up and alternatives are urgently needed. SOMO’s work seeks to expose and challenge the monopoly power of Big Tech to develop a just and sustainable digital economy.

Reining in monopoly and rentier power in the healthcare sector

The healthcare industry represents a promising frontier for major tech companies as they rapidly extend their influence to public healthcare systems worldwide. Companies like Amazon, Google, and Microsoft are investing significantly in developing digital health infrastructures, data storage, collection, and analysis.

However, this rapid expansion has sparked concerns about patient privacy and other issues. There is a worry that a handful of large, wealthy multinational corporations could gain significant operational control over public health systems and the associated data due to their development and maintenance of digital infrastructure. Consequently, there is a growing fear that societies and governments may lose control of their public healthcare systems over time.

In the context of the pharmaceutical industry, rentier power refers to the ability of pharmaceutical companies to maintain significant profits and control over drug pricing, without necessarily introducing substantial advancements in drug development or lowering production costs.

-

The financialisation of Big Pharma (pdf, 339.03 KB)

With limited or no competition, pharmaceutical companies can set high drug prices, often leading to financial burdens for patients and healthcare systems. Large pharmaceutical companies may also acquire smaller competitors or collaborate with them to expand their portfolio of drugs and strengthen their market position. These mergers and acquisitions can reduce competition and further consolidate the industry’s monopoly.

Monopolies also stifle innovation, as companies prioritise profit maximisation over developing new and potentially more effective treatments.

Our research at SOMO delves into the monopolistic power of Big Pharma and Big Tech companies concerning public health data infrastructures and health datasets.

Leveraging public data and governments

As well as accumulating rents, Big Tech companies have also built substantial power over the economy and society. Their infrastructural power also affects sovereign states. Big Tech companies are getting increasingly involved in public service delivery. By doing so, they gain access to, and exploit, large amounts of public data. This is yet another extension of the monopoly problem.

Having Big Tech companies leveraging public data and governments raises particular concerns. A company like Google can offer its services at cost in exchange for walking away with the intellectual property of the algorithms it has built off large and valuable public datasets – forcing governments to have to buy back access to those algorithms. When governments fail to invest in public sector technology and data use, they create dependence on Big Tech platforms to deliver public services.

The exploitative economic model of these Big Tech corporations is only now beginning to be adequately documented and understood. More research is urgently needed to delve into the rise of public-private partnerships between Big Tech companies and governments.

We are supporting efforts to strengthen European competition legislation. We are focusing mainly on Big Tech, as monopolistic behaviour is widespread in this sector.

Digital Markets Act and regulations

From Big Pharma to Big Tech, intellectual property (IP) facilitates rentier power by focusing ownership of scarce assets. Our focus at SOMO is on dismantling mechanisms like IP that specifically enable rentier behaviour.

We welcomed the Digital Markets Act(opens in new window) , which should – if appropriately enforced – allow for the rebalancing of digital markets, increasing citizens’ and consumer protection and choice, and ending many of the harmful practices that Big Tech companies have engaged in over the years.

The Digital Markets Act (DMA) is a European law that came into force in May 2023. It aims to prevent Big Tech companies and their platforms from abusing their market power, setting a high standard for platform regulation. The DMA paves the way for stronger regulation to come.

We are also exploring different opportunities to set the agenda on competition in Europe, including through our work on digital trade rules, the revision of the OECD Guidelines for Multinational Enterprises and the EU-US Trade and Technology Council.

Since tax policies often support and encourage monopoly and rentier strategies, we dedicate a substantial part of our work to expanding the priorities in the tax justice landscape to address monopoly power and rentier structures, including by promoting taxes on dividends, profit tax, and capital gains tax.

Do you need more information?

-

Rodrigo Fernandez

Senior researcher -

Margarida Silva

Researcher

Latest updates

-

-

EU health data law rolls out the red carpet for Big TechPosted in category:Long read

EU health data law rolls out the red carpet for Big TechPosted in category:Long read Irene SchipperPublished on:

Irene SchipperPublished on: -

Related Topics

Discover more of SOMO’s work and publications.