Hungry for profits

How monopoly power tripled the profits of global agricultural commodity traders in the last three years

UPDATE

On 1 August 2024, the European Commission approved the merger between the global agricultural traders Bunge and Viterra, instead of starting a Phase II investigation into this merger and its consequences.

We think this massive merger should have been subject to further investigation, and we commissioned an analysis that shows all the reasons why the European Commission should have gone deeper.

-

A new merger wave in the agri-food value chain? Some reflections on the Bunge/Viterra merger (pdf, 2.23 MB)

A new merger wave in the agri-food value chain? Some reflections on the Bunge/Viterra merger (pdf, 2.23 MB)

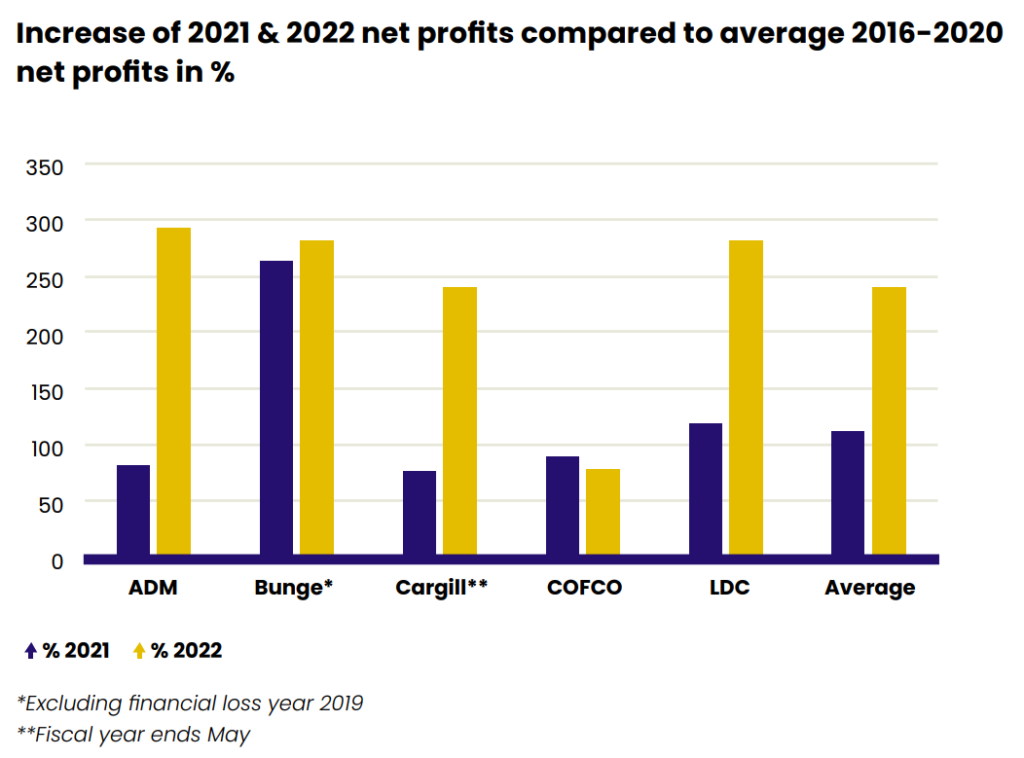

In the last three years, the profits of the five biggest traders in agricultural commodities tripled compared to the years before. Together, ADM, Bunge, Cargill, COFCO and Louis Dreyfuss Company (ABCCD) hold a monopoly position on the global market for staples like grain, corn, soy and sugar. This enables them to influence pricing and costs, which resulted in their excessive profits and fuelled inflation, our report Hungry for Profits argues.

Hungry for profits

-

Hungry for Profits (pdf, 1.29 MB)

Hungry for Profits (pdf, 1.29 MB)

- ADM, Bunge, COFCO, Cargill and Louis Dreyfuss Company together control between 70 and 90 per cent of the global trade in commercial grains;

- They are strongly vertically integrated, controlling a large part of food supply chains, working together closely through joint ventures and shared investments, and collecting large amounts of data on harvests, prices, and political developments in all parts of the world;

- Their interconnectedness and market power are likely what allowed them to drastically increase their profit margins, leading to a tripling of their profits, boosting inflation, and worsening a global food crisis;

- How the ABCCDs were able to excessively increase their margins on food commodities – generally interchangeable products traded on globalised markets – is unclear, though an emerging body of research provides explanations in the form of abuse of market power and oligopolistic price fixing;

- In 2024, Viterra and Bunge announced their merger in a deal unprecedented in size in the global agricultural sector. This merger further strengthens the ABCCD’s dominant market position.

As people all over the world struggle with hunger and ever-rising costs of living, the five largest agricultural commodity traders announced their biggest profits ever. In 2022, the profits of the ABCCD tripled compared to the 2016-2020 period. Based on publicly available quarterly reports, it is very likely that 2023 will again be an extremely profitable year for companies pulling the strings in the food supply chain.

Monopoly power

In this research, the focus is on the five dominant companies in the global food supply chain. As a group, the Big Five control between 70 and 90 per cent of the global trade in commercial grains. Furthermore, they exert a high level of control on the main export markets of soy (Brazil, the United States, Paraguay and Argentina).

“This high degree of concentration, and resulting control over the world’s most important agricultural commodities, gives these firms enormous bargaining power to shape the global food landscape.”

SOMO researcher Vincent Kiezebrink

They hold their powerful position in the food supply chain due to a vast network of contracted agricultural suppliers, storage, processing (crushing), and transportation in core strategic food-producing countries or regions.

Big Agri loves Big Data

The ABCCDs supply farmers with loans, seeds, fertilizers and pesticides; they store, process and transport food commodities. Due to the companies’ involvement at most stages of the production process, companies have unique access to valuable market data. This information puts them at a huge advantage over other parties in the food supply chain and can be used to influence and control the production stage all the way to processing.

This privileged position with regard to data seems especially advantageous when the agricultural commodity market is volatile and troubled, as in the current ongoing food crisis. In times of price spikes and volatility, insights into the future supply of relevant agricultural commodities are key.

Inflation and profiteering

The report also analyses research on inflation and profiteering by leading institutions and companies. High profits, as realised by the agricultural commodity traders in the last three years, can be partially explained by profiteering. Considering the strong and dominant market power of the agricultural commodity traders and their clear track record with regard to anti-competitive behaviour, the potential correlation with the recent extraordinary profits is not to be underestimated.

“We do not have a food crisis; we have a price crisis. The food corporations are shamelessly exploiting their monopoly power to artificially inflate prices. This greedflation must finally be put to a stop. We must break up these ruthless corporations, stop mega-mergers and tax their windfall profits.”

Martin Schirdewan, Member of the European Parliament

Curb monopoly power

The agricultural commodity trade market has become more and more concentrated. Since 1990, The EU competition regulators have assessed a total of 60 ABCCD cases of mergers and acquisitions. All but one have been approved unconditionally.

The next big planned merger is between Viterra and Bunge. The deal is unprecedented in size and will move the new company closer to the size of ADM and Cargill. The EU Commission still needs to assess this merger, which has already been approved by Bunge’s and Viterra’s shareholders.

The European Commission can stop the trend of ever-growing monopolisation. By investigating the various markets in which the ABCCD companies are active, including their horizontal and vertical integration, as well as the joint ventures and other cooperation agreements they have. The investigation should focus on the market power that can be exercised against suppliers to squeeze their profit margins.

In the short term, governments could implement a windfall profit tax in relation to large agricultural commodity traders, coupled with price gouging laws that would stop excessive price rises in times of emergency. It is a troubling reality that corporations have been allowed to triple their profits by driving up food prices while people around the world suffer from a cost-of-living crisis, and the world’s poorest are driven to hunger.

Hungry for Profits

-

Hungry for Profits (pdf, 1.29 MB)

Hungry for Profits (pdf, 1.29 MB)

Do you need more information?

-

Vincent Kiezebrink

Researcher

Related news

-

-

SOMO strategy 2021 – 2025 Published on:Posted in category:Publication

-

Share buyback Dutch supermarket significant loss for the Dutch economyPosted in category:Opinion

Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: Rodrigo Fernandez

Rodrigo Fernandez