Fifty shades of tax dodging

The EU´s role in supporting an unjust global tax system

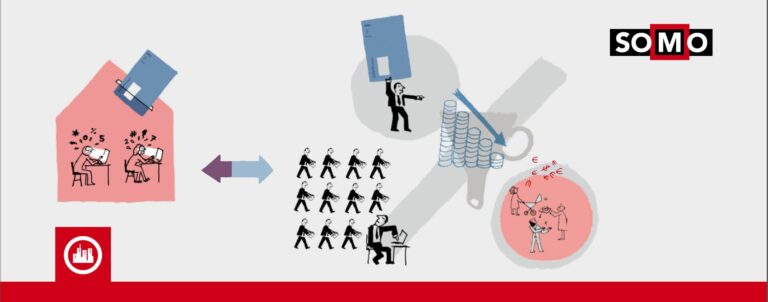

In the past year, scandal after scandal has exposed companies using loopholes in the tax system to avoid taxation. Now more than ever, it is becoming clear that citizens around the world are paying a high price for the crisis in the global tax system, and the discussion about multinational corporations and their tax tricks remains at the top of the agenda. There is also a growing awareness that the worlds poorest countries are even harder impacted than the richest countries. In effect, the poorest countries are paying the price for a global tax system they did not create. A large number of the scandals that emerged over the past year have strong links to the EU and its Member States. Many eyes have therefore turned to the EU leaders, who claim that the problem is being solved and the public need not worry.

But what is really going on? What is the role of the EU in the unjust global tax system, and are EU leaders really solving the problem? This report the third in a series of reports – scrutinises the role of the EU in the global tax crisis, analyses developments and suggests concrete solutions. It is written by civil society organisations (CSOs) in 14 countries across the EU. Experts in each CSO have examined their national governments commitments and actions in terms of combating tax dodging and ensuring transparency.

Partners

Publication

Accompanying documents

Related content

-

-

A year after Luxleaks, most EU countries still fail to tackle tax dodgingPosted in category:NewsPublished on:

A year after Luxleaks, most EU countries still fail to tackle tax dodgingPosted in category:NewsPublished on: -

Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodgingPosted in category:NewsPublished on:

Giving with one hand and taking with the other – CSOs urge European leaders to take further action against tax dodgingPosted in category:NewsPublished on: