Compensation for stranded assets?

German energy giants claim billions in public funds for loss-making Dutch coal-fired power plants.

The transition to a low-carbon society requires a massive effort from governments, private companies and citizens alike. But the Energy Charter Treaty (ECT) gives fossil fuel companies a powerful legal tool to shift the transition risks and associated costs to governments and taxpayers. German utilities RWE and Uniper are suing the Netherlands for billions of euros under the ECT for adopting a law that prohibits coal-fired power generation by 2030. Despite increased climate commitments and worsening market conditions for coal, these companies, together with French utility Engie, willingly decided to put brand new coal-fired power plants into service in 2015 and 2016.

New research by IEEFA and Ember, in collaboration with SOMO, shows that the three companies were already making huge devaluations of their plants years before the 2019 coal prohibition law. This was due in large part to the uncompetitive economics of coal-fired generation in general, driven by rising carbon prices and cheaper energy generation from renewables and gas plants. Power generation by these three plants has been decreasing over the past three years, while profits have plummeted since 2018. The plants are all expected to run at net annual losses from 2022 and will no longer be economically viable by 2024 at the latest.

This suggests that the energy companies made poor, short-sighted investment decisions and they are now trying to get taxpayers to pay for their stranded assets by suing the Netherlands. This would set dangerous precedents and could impede similar coal phase-out strategies in other countries by exposing states to substantial and unreasonable compensation claims. Governments should therefore consider withdrawing from the ECT as it currently acts as a brake on the energy transition.

In 2015, the Netherlands became one of the 195 signatory countries to the Paris Agreement on Climate Change(opens in new window) , which sets out to limit global warming to 2°C above pre-industrial levels and to pursue efforts to limit warming to 1.5°C. To reach that target, scientists (opens in new window) have calculated that the majority of fossil fuel reserves, including over 80% of global coal reserves, must remain unused. Others (opens in new window) have suggested that “little or no new CO2-emitting infrastructure can be commissioned, and that existing infrastructure may need to be retired early (or be retrofitted with carbon capture and storage technology)”.

Necessary climate action will inevitably lead to “stranded assets”, which are commonly defined (opens in new window) as “assets that have suffered from unanticipated or premature write-downs, devaluations, or conversion to liabilities”. Coal is under particularly severe economic pressure due to rising carbon prices and cheaper energy generation from renewables. According to Carbon Tracker(opens in new window) , 62% of coal capacity in the EU was already unviable in cash flow terms in 2019 and the entire EU coal fleet is expected to be uncompetitive as early as 2025.

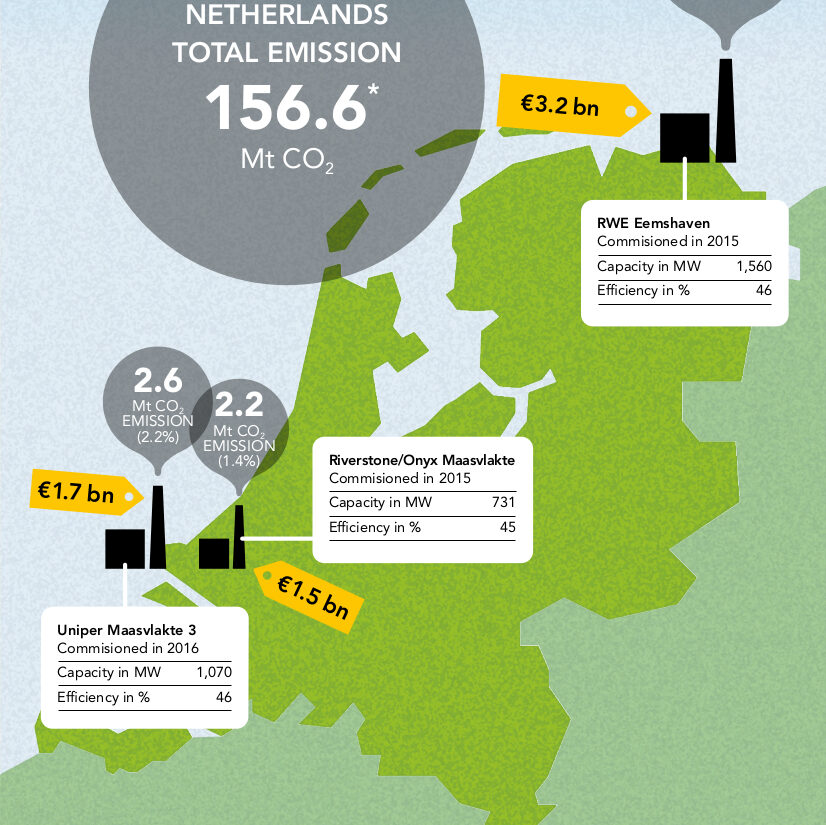

Against this backdrop, three energy companies – German RWE, Uniper and French Engie (now Riverstone) – connected three brand new coal-fired power plants to the Dutch grid in 2015 and 2016, with a combined capacity of 3.4 GW. As a result, Dutch coal-fired power generation briefly increased, but ever since its share has been rapidly declining (opens in new window) in favour of solar, wind and gas. A 2016 report(opens in new window) by IEEFA already warned that the new plants were bad, short-sighted investments by the utility companies, as worsening coal economics driven by cheaper renewables, costlier carbon and increasing climate commitments would likely render the plants obsolete well before their intended operational lifetimes of forty years.

The Dutch coal phase-out

In December 2019, a new law(opens in new window) was adopted that prohibits the use of coal for electricity generation as of 2030. The law forms a key part of the Dutch government’s climate ambitions to realise a 49% emission reduction by 2030 compared to 1990, and 95% by 2050, which became anchored in a national climate law(opens in new window) adopted in July 2019. The coal prohibition law affects the five remaining coal-fired power plants in the Netherlands. The Vattenfall-owned Hemweg power plant was decommissioned on 23 December 2019 in return for a compensation of €52.5 million. RWE’s Amer plant needs to stop burning coal before 2025, and will fully shift to biomass by then, while the three new plants need to phase out coal before 2030. No financial compensation has been made available for this, but the transitional period is believed(opens in new window) to allow the power plant operators to (partially) recover their investments and prepare the plants for further operation with fuels other than coal.

Enter the Energy Charter Treaty

The owners of the three new plants have at various times expressed their right to compensation and threatened legal action, including under the Energy Charter Treaty(opens in new window) (ECT). The ECT allows foreign investors and their shareholders in the energy sector to sue governments before international arbitration tribunals to claim compensation for adverse state measures that may jeopardize their investment interests. Like many of the nearly 3,000 existing investment treaties, it grants foreign investors substantive protections that extend beyond those found in many domestic legal systems and EU law. These protections consist of broad and vaguely-worded standards that are generally open to wide interpretation.

Among other things, the ECT requires governments to treat foreign investors no less favourably than domestic investors or investors from third countries. It also obliges governments to provide investors fair and equitable treatment, which has been interpreted(opens in new window) as protecting investors’ legitimate expectations regarding their business plans and future government conduct. And it sets out conditions for both direct and indirect expropriation to be lawful, the latter being a catch-all standard that may cover a wide variety of regulatory measures that severely affect the use of an asset.

The ECT orders governments to pay the fair market value in case of expropriation, but it does not further specify how to determine that value nor what methods to use for breaches of other investment protection standards. Tribunals have often resorted to general principles of international law(opens in new window) , under which “reparation must, as far as possible, wipe out all the consequences of the illegal act and re-establish the situation which would, in all probability, have existed if that act had not been committed.” Compensation amounts can expand to billions of euros, particularly when the arbitrators apply income-based approaches incorporating expected future earnings to assess(opens in new window) the value of an affected asset. This could potentially lead to situations of overcompensation(opens in new window) in the case of fossil fuel assets that are likely to become stranded.

Governments could feel compelled to drop or water down climate policy measures in fear of expensive and unpredictable ECT arbitration, leading to situations of regulatory chill(opens in new window) , or they could end up paying more compensation than anticipated because of negotiations taking place under the shadow of the ECT. For example, the European Commission recently opened a state aid investigation(opens in new window) into a €4.35 billion compensation paid to RWE and Leag for early closure of their lignite-fired power plants in Germany, for which the companies reportedly(opens in new window) waived their right to sue the German state under the ECT.

Phasing out coal as foreseeable government action

In February 2021, RWE lodged a claim(opens in new window) against the Netherlands under the ECT, thereby seeking €1.4 billion in compensation for damages resulting from the new law. In its press release(opens in new window) , RWE states that “due to the coal phase-out act and the fact that biomass as a substitute fuel is not economically viable without subsidies, RWE will not be able to operate the Eemshaven power plant profitably from 2030 onwards”. Uniper is preparing (opens in new window) a similar claim under the ECT, and referred earlier to expected damages of between €850 million and €1 billion. Both RWE and Uniper are also suing the Dutch state in national courts.

Although the arbitration requests remain undisclosed, in various public outlets both companies have suggested that they could expect to achieve a reasonable return on investment over the lifetime of their plants. RWE(opens in new window) and Uniper(opens in new window) argue that these expectations were partly reinforced by a “reliable investment climate” created by the Dutch state, which at the time intended to diversify energy supply in the Netherlands – and make it less dependent on gas – and promoted the country as an attractive location for coal energy companies.

The companies also claim(opens in new window) that they could not foresee a full ban on coal-fired power generation by 2030 until after the adoption of the Paris Agreement in 2015, and a parliamentary resolution adopted around the same time calling on the government to develop a plan for phasing out coal. Before that, the companies still assumed they would be able to operate their plants for their full life cycle. Because alternative forms of power generation are not considered economically viable at the moment, the law is said(opens in new window) to constitute a de facto expropriation for which compensation is required.

However, the energy companies fail to mention that at the time when the permits were issued (2006-2008) and in the years after that, the Dutch government communicated(opens in new window) that it expected the plants to undertake efforts to reduce emissions and expressed its ambitions to have new coal plants delivered as “capture-ready” from 2010. The environmental permit for the RWE Eemshaven plant states(opens in new window) that “the large amount of CO2 released in energy production from fossil fuels, including coal, must be held responsible for some of the global warming/climate change.”

At the same time, the owners of the plants promised(opens in new window) to develop large-scale carbon capture and storage (CCS) techniques to mitigate the additional emissions. The 2013 Energy Agreement for Sustainable Growth(opens in new window) , supported by more than 40 organisations among which the private sector, trade unions, civil society organisations and financial institutions, committed to closing five older coal-fired power plants from the 1980s, while stressing the importance of CCS for the other plants.

In 2015, a Dutch court found in the historic Urgenda-case(opens in new window) that the Dutch government has a legal duty to prevent dangerous climate change and ruled that the government must reduce emissions by 25% by 2020 compared to 1990. However, emissions actually increased, with the three plants responsible for an additional 16.2 Mt CO2 in 2016 (10% of total(opens in new window) CO2 emissions in the Netherlands), and all three plants have been consistently in the top ten of biggest polluters(opens in new window) in the Netherlands since their opening. Despite millions of euros in subsidies from the Dutch government and the European Union, the owners of the new plants ultimately have failed(opens in new window) to apply large-scale CCS. New measures forcing the plants to reduce emissions were therefore foreseeable, with phasing out coal altogether being the most obvious one.

Under Article 4, the coal prohibition law allows for the possibility of compensation if it imposes an individual excessive burden on one of the owners of the coal plants. So far, neither RWE nor Uniper have made a request for compensation under Article 4. Likewise, both companies declined to participate in a government call for proposals(opens in new window) in September 2020 whereby the owners of the plants could submit a proposal for closure in return for a maximum of €328,000 subsidy per closed MW. This would mean a maximum available subsidy of €512 million for RWE’s Eemshaven, €351 million for Uniper’s Maasvlakte 3, and €240 million for Riverstone/Onyx’s Maasvlakte plant. The proposal explicitly states that to prevent unlawful state aid, the subsidy should not exceed the lost revenue plus the cost of dismantling the plant. Only Riverstone responded to the call and although its submission remains confidential, it is reportedly(opens in new window) asking for nearly the full amount: €238 million. For RWE and Uniper, these amounts are apparently not high enough and both seem to be aiming for higher compensation through litigation under the ECT.

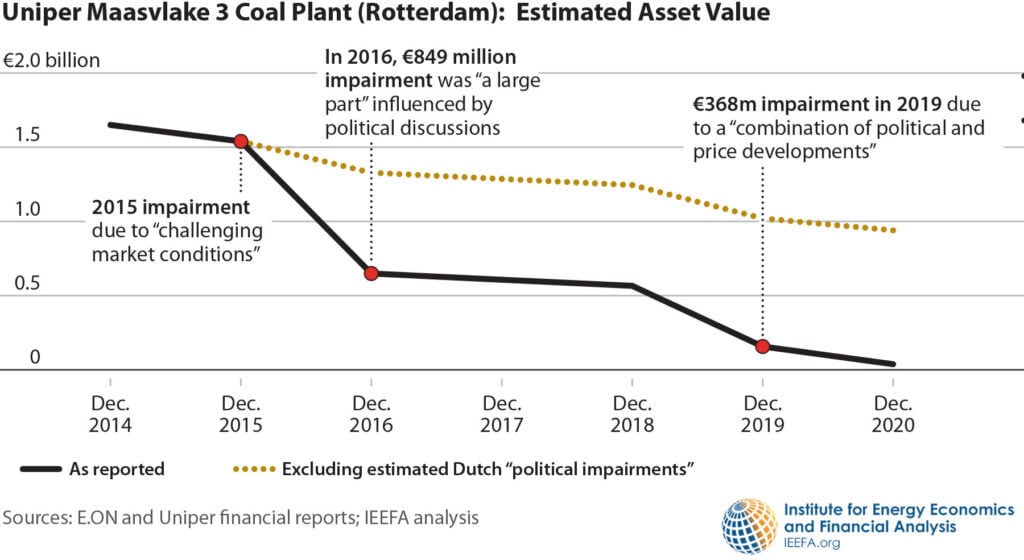

Estimated asset valuations of the Dutch coal plants

The owners of the three new coal-fired power plants have stated at various times that the plants have cost a total of more than €6 billion and that their plants will only have depreciated for half their value by 2030. However, new analysis by think tanks Ember (opens in new window) and IEEFA(opens in new window) , in collaboration with SOMO, suggests that the three plants are already loss-making and have been largely written-down. This is not only due to the Dutch coal phase-out law, but also due to the uncompetitive economics of coal-fired power generation in general, driven by a rising carbon price and cheaper energy generation from renewables and gas plants.

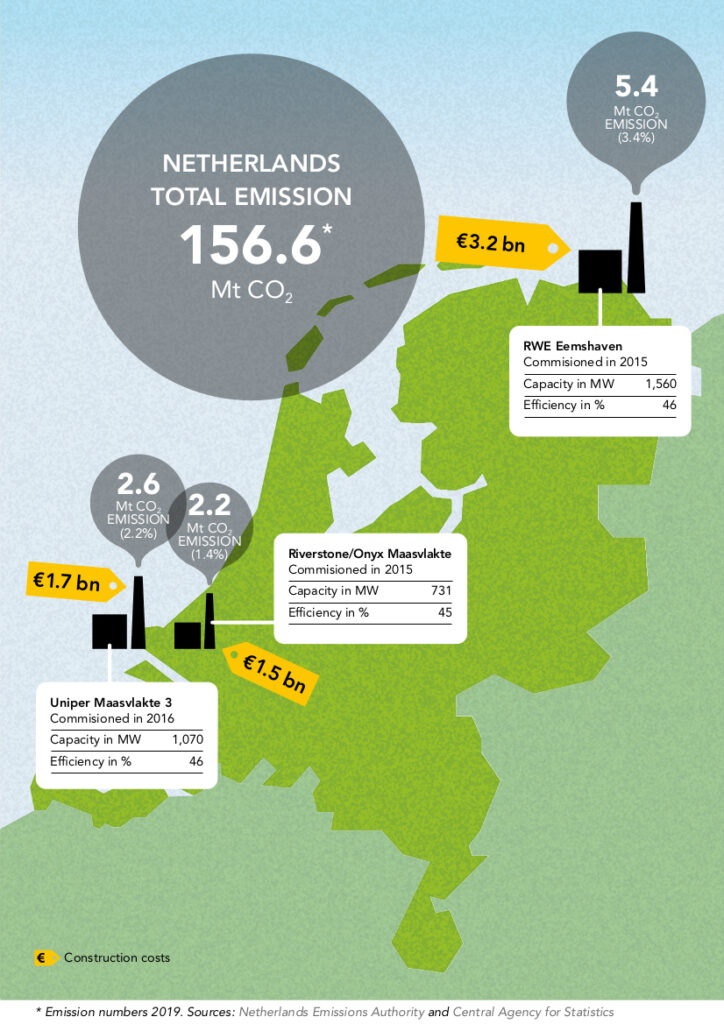

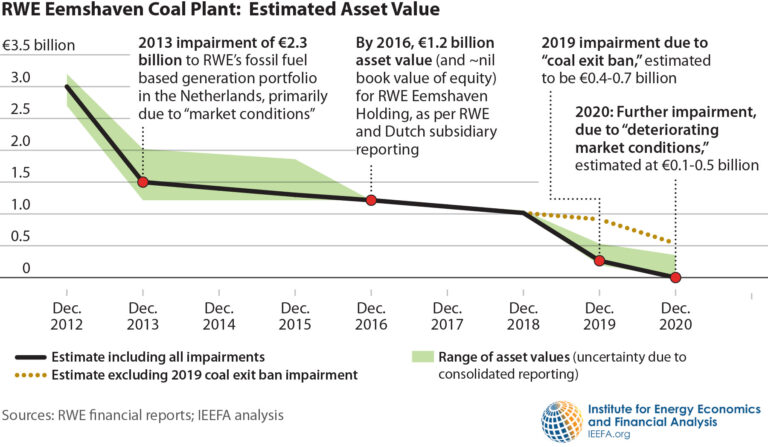

Financial statements of the Dutch RWE subsidiary, RWE Generation NL Participations B.V., indicate that Eemshaven had a “carrying amount” of €1.2 billion in assets on the balance sheet in 2016. However, it also had €1.2 billion in financial liabilities, meaning its equity book value, or the accounting-based value to its owners, had already gone down to zero, years before the Dutch coal ban came into effect and despite the abolition of the Dutch coal tax as of 1 January 2016.

Figure 2 shows how RWE’s original planned €2.7 billion investment in Eemshaven (which ballooned to €3 to 3.2 billion) has rapidly collapsed in value, with only €0.4–0.7 billion of that reduction explicitly attributed to the Dutch coal phase out law, based on RWE’s financial reports since 2010. The huge write down in 2013 was attributed(opens in new window) to “the current assessment of the medium to long-term development of electricity prices, the regulatory environment, and the lower utilisation of parts of the fossil-fuelled power plant portfolio”. If the plant had operated as planned, Figure 2 would have shown a straight line gradually decreasing to zero over the power plant’s 30 to 40 year lifetime. This gradual decrease would signify the plant losing value year on year as its expected productive period comes closer to its end. Instead of this gradual decrease, however, the figure shows the sharp decline in RWE’s own valuation of its Eemshaven plant, as the economic conditions for coal-fired power plants continuously worsen. Only the relatively small drop in value in 2019 is actually related to the Dutch coal ban.

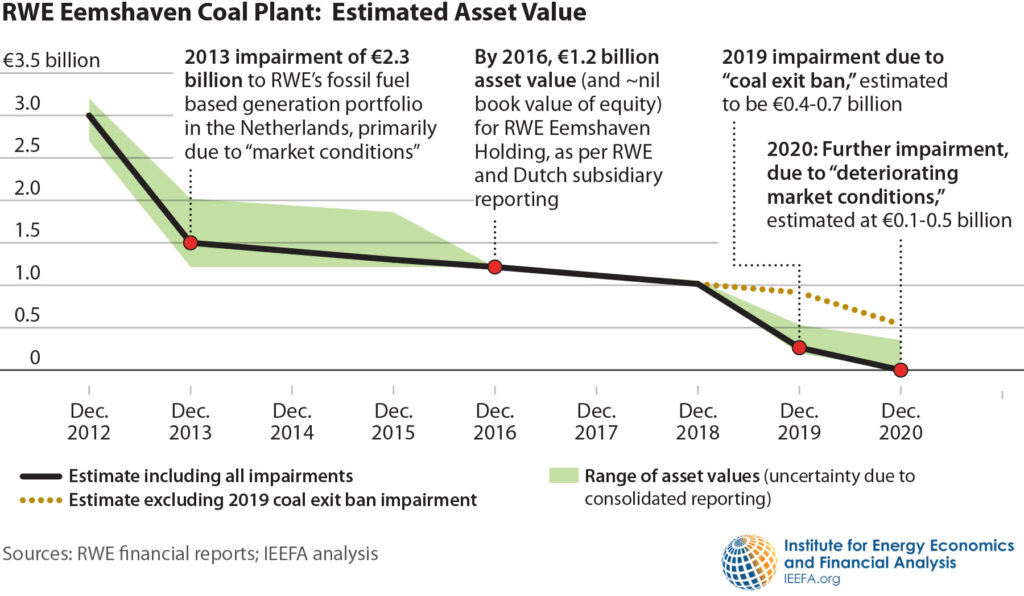

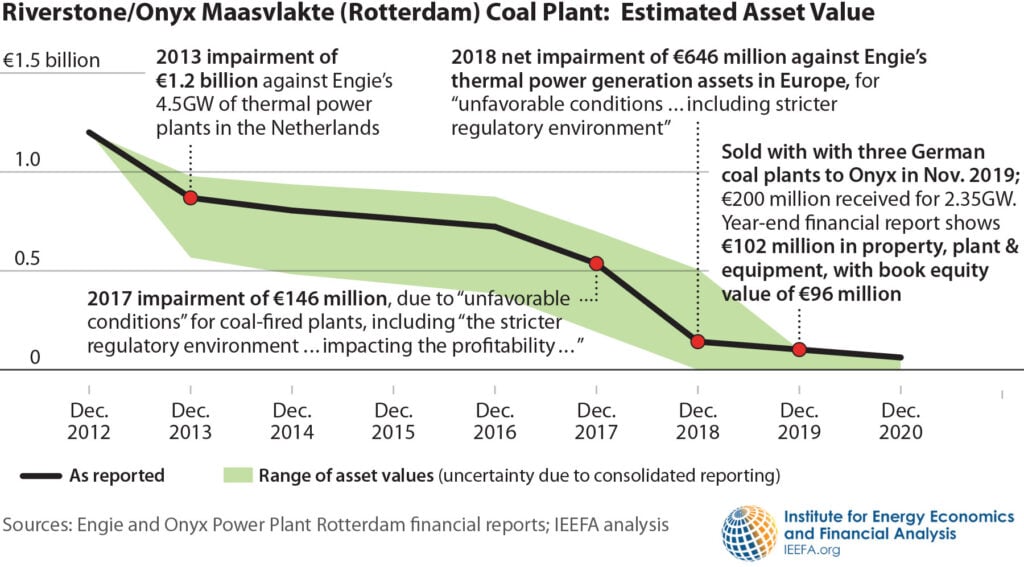

Figures 3 and 4 show that Uniper and Engie/Riverstone have made significant write-downs on their coal plants as well, although both seem to largely blame regulations for much of their impairments. Uniper’s reporting suggests that up to €1 billion of impairments at its Maasvlakte 3 power plant were explicitly attributed to the Dutch coal phase-out regulation.

Comparable market valuations of coal plants

Recent transactions involving comparable power plants offer some indication of rapidly declining market prices of coal-fired power plants. In 2019, Engie sold(opens in new window) its new plant in Rotterdam, along with one similar and two older coal plants in Germany, to Riverstone Holdings LLC, a private equity investor, for just €190 million. At the end of 2019, Riverstone’s Dutch subsidiary reporting shows a book equity value of €96 million for the Rotterdam plant, which suggests it represented just over half of the deal’s value. Reportedly, Engie invested approximately €1.5 billion in the construction of the same plant.

Also in 2019, Uniper sold its French generation assets to private firm EPH, which is owned by Czech billionaire investor Daniel Kretinsky. The transaction included two coal power generation units (600 MW each), two gas-fired power plants (400 MW each), a 150 MW biomass power plant and 100 MW of wind and solar generation capacity. The sale price was undisclosed, however Uniper confirmed(opens in new window) the net disposal proceeds were of an “immaterial” amount and reported a negative equity value of -€102 million for the disposal group, as of the transaction date. While the French market differs from the Dutch market, it nevertheless underscores the dire state of conventional plant valuations in Europe, independent of the Dutch coal phase-out law.

Moreover, Vattenfall offered to close the Moorburg coal plant in September 2020 as part of a German auction(opens in new window) aimed at phasing out coal power. It has since been announced by the German government that Vattenfall received a maximum of €150,000 per closed MW, which amounts to a maximum of €240 million for closing the entire power plant. The Moorburg plant has a similar design to RWE’s Eemshaven plant: both opened in 2015, have a capacity of around 1,600MW and are accessible for sea vessels.

The declining generation and profitability of the Dutch coal plants

See this methodology for the underlying calculations and assumptions.

Market forces, such as rising EU-ETS carbon prices and the increased deployment of renewable electricity, are affecting the generation and profitability of coal-fired power plants across the EU.

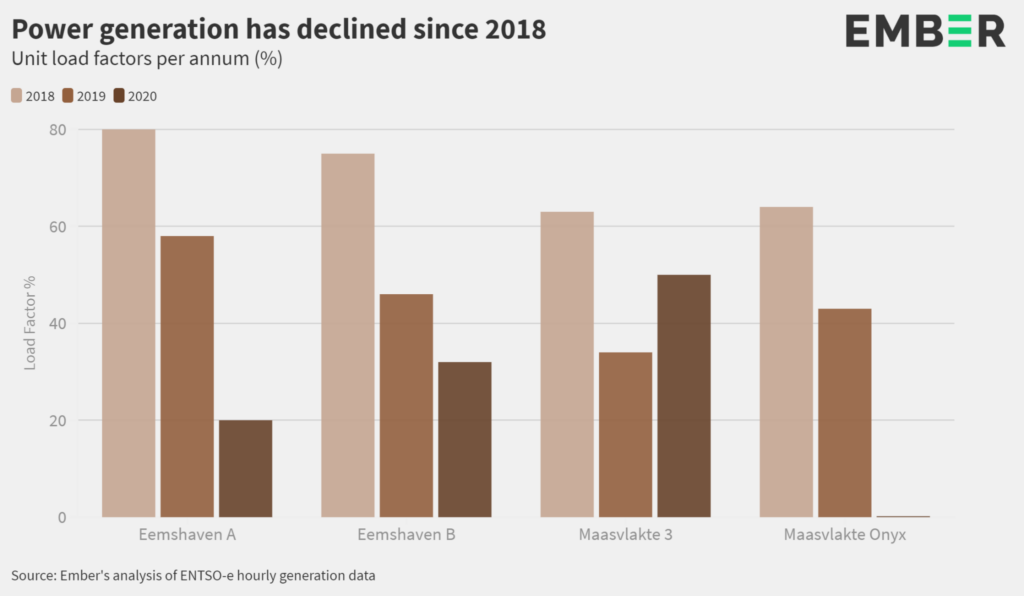

Power generation by these three new coal-fired power plants in the Netherlands has been decreasing over the past three years. Figure 5 shows that average have dropped since 2018. Both units of RWE’s Eemshaven plant had an average load factor of 26% in 2020 compared to 52% in 2019 and 78% in 2018. Uniper’s Maasvlakte 3 had an average load factor of 50% in 2020 compared to 34% in 2019 and 63% in 2018. Its load factor actually increased in 2020 year-on-year because it had a six-month outage from April to October 2019. The Onyx Power Plant at Maasvlakte has been offline since February 2020 due to a technical breakdown. Prior to the unplanned shutdown, the load factors were 64% and 43% in 2018 and 2019 respectively.

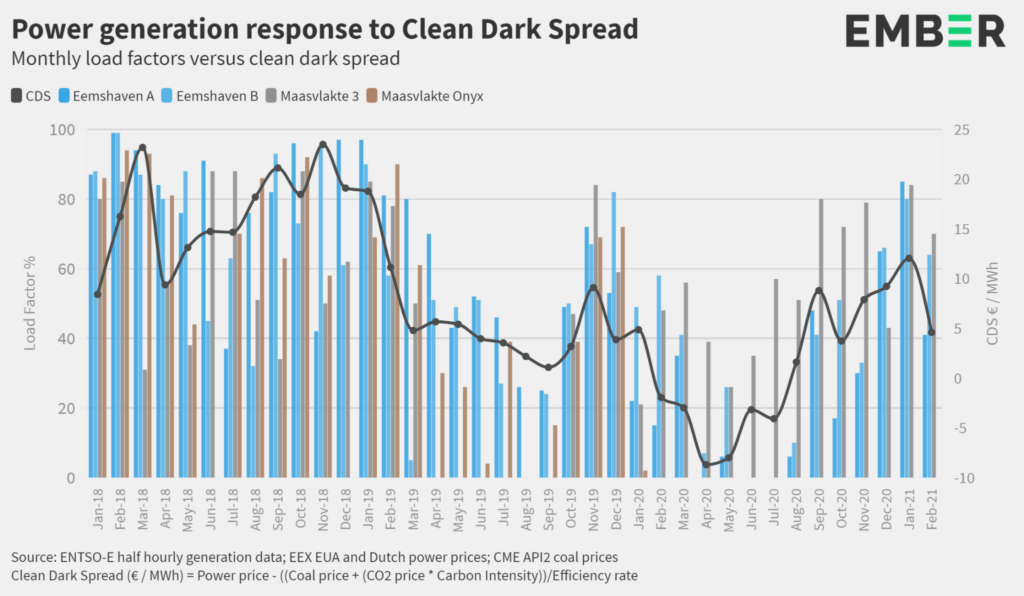

At the moment, there is a low Clean Dark Spread on the wholesale market. The CDS measures the profitability of coal-fired power generation based on the margin between the purchase cost of coal and CO2 emission allowances and the price received for the electricity output. The CDS averaged €17/MWh in 2018. This fell substantially to €6/MWh in 2019 and to an average of €0.6/MWh in 2020, partially due to Covid-19 causing a drop in electricity demand and prices. In February 2021, the CDS was sitting at only €4.60/MWh. Therefore, the coal-fired power plants are increasingly struggling to recover not only their fixed costs, but also some of their variable costs. Figure 6 shows that the coal plants tend to be responsive to change in the spread.

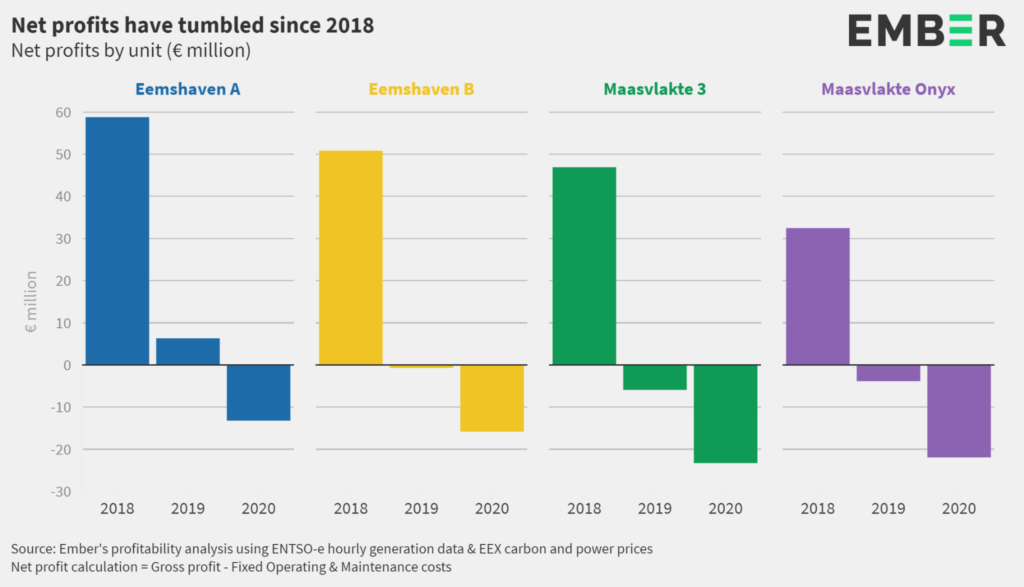

Net profits for all units collapsed from €189 million in 2018 to become net losses of €4 million in 2019 and net losses of € 74 million in 2020. The net profit of RWE Eemshaven dropped by 95% to only €5.6 million in 2019 and further decreased to a net loss of almost €30 million in 2020. Uniper Maasvlakte 3 had net losses of almost €6 million in 2019, partly due to the six-month outage from April to October, and over €23 million in 2020. Net profits for Onyx Maasvlakte were €32 million in 2018 but tumbled to net losses of €4 million in 2019, and the plant has not been in operation since February 2020.

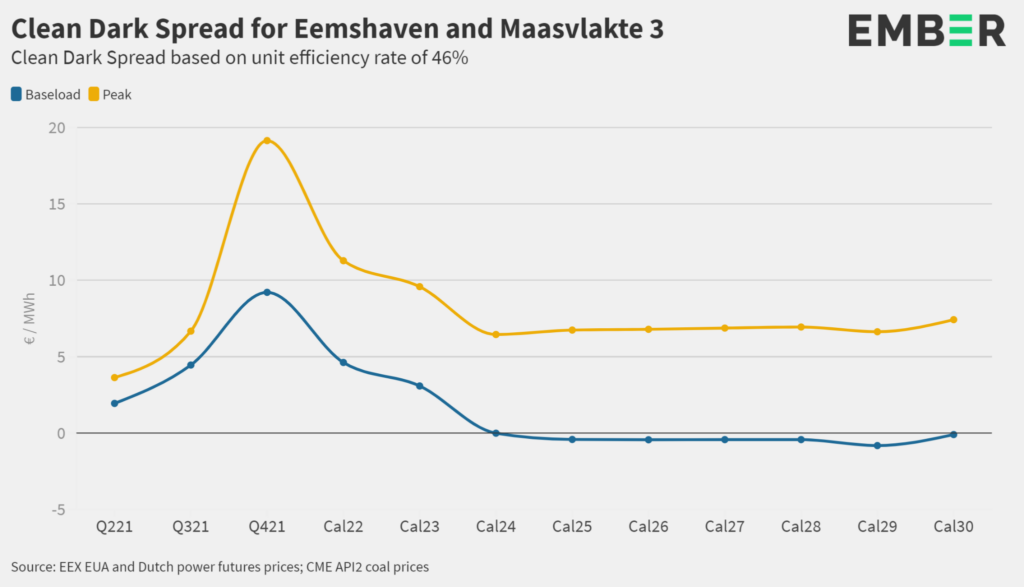

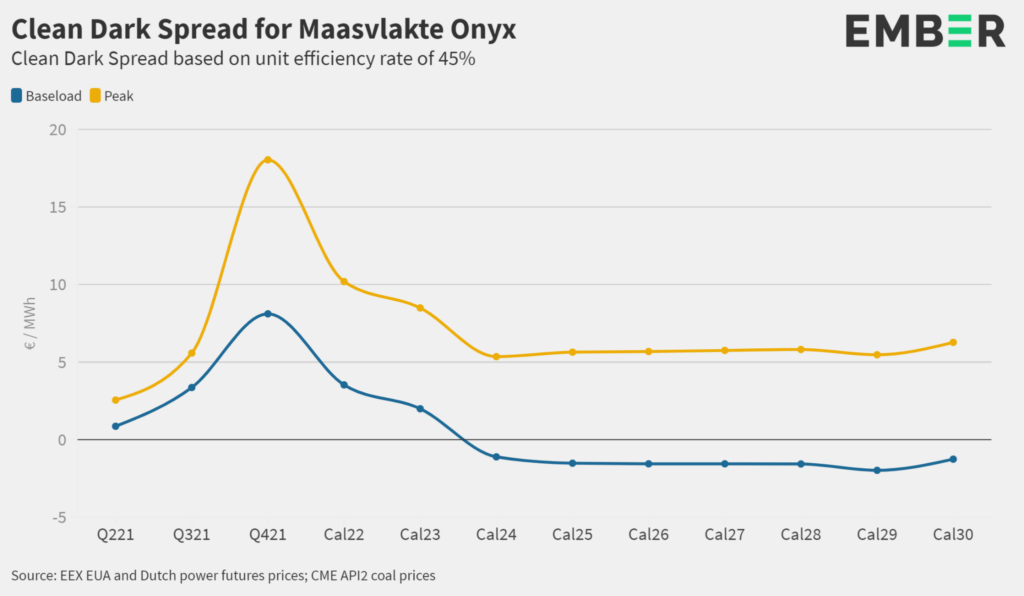

Future profitability

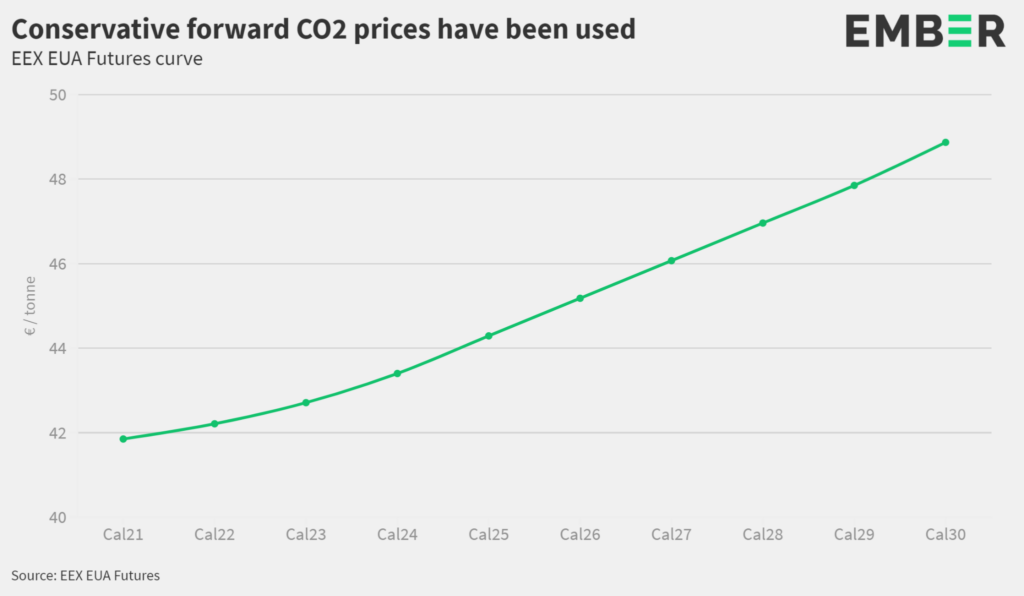

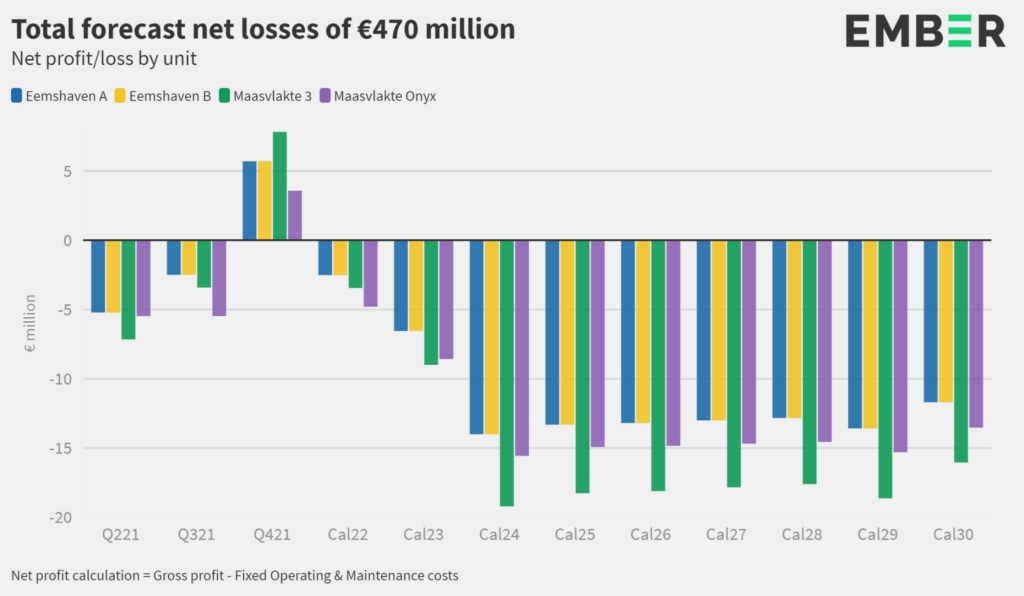

The potential future profitability analysis includes all four power station units. For the purpose of this report, it has been assumed that Maasvlakte Onyx will come back online in October 2021. In terms of future profitability, the analysis finds that all units would be unprofitable if running for baseload generation except in the fourth quarter of 2021. This is based on forward projections of the Clean Dark Spread minus variable and fixed operating costs. Figures 8 and 9 illustrate the peak and baseload Clean Dark Spreads using coal, CO2 and electricity prices from 29 March 2021. Even before any non-fuel variable and fixed operating and maintenance costs are deducted, the baseload spread is negative from 2024 onwards.

The Clean Dark Spreads have been calculated using EEX futures prices(opens in new window) for carbon credits (EUAs) in the EU Emissions Trading Scheme. Figure 10 shows the forecast carbon prices used in this analysis. Many indicators suggest that the carbon prices in the current futures market are substantially underestimated. A recent EWI analysis(opens in new window) sets CO2 prices at €48/tonne in 2028, €56/tonne in 2030 and €78/tonne by 2035. At the same time, power prices are expected to fall or remain relatively flat as cheaper wind and solar sources come online.

For the gross profit calculations, it has been assumed that the units will only generate electricity when the Clean Dark Spread, minus non-fuel variable costs and coal transportation costs (€2.50/MWh), is positive. For the calculation of net profits/losses, the fixed operating and maintenance costs are deducted from the gross profits and are estimated at €30/kW/year for all four units. These costs are fixed regardless of the number of operating hours or volume of power generated. Based on these assumptions, the plants are expected to consistently run at net losses from 2022 (Figure 11). Total net losses are €470 million for all four units. If Maasvlakte Onyx does not come back online in any capacity, then it will not generate any revenue and the total net losses across the four units will increase to €560 million

Biomass subsidies

All three power plants receive subsidies(opens in new window) for co-firing with biomass (€930 million for Eemshaven, €630 million for Maasvlakte 3, and €296 million for Maasvlakte). The subsidies compensate the utilities for a proportion of their generation and associated costs (fuel, CO2, operating and maintenance, and capital costs) if these costs are above the Dutch baseload electricity price (APX). Biomass subsidy calculations have not been incorporated into the above analysis. The Dutch government intends to end all biomass subsidies in 2027. Consequently, even if the current subsidies are enabling the power stations to survive, this will not be the case from 2027 onwards and they will then be exposed to the full market conditions and prices. Further information on biomass subsidies can be found in this report(opens in new window) .

Conclusion

These findings confirm that hard-coal energy generation in the Netherlands has become an unprofitable business over the past years. Based on estimated market developments and prices, it is expected that the three new coal plants will no longer be economically viable by 2024 at the latest, and no profits could possibly be expected after 2030. The energy companies made poor investment decisions in constructing new coal plants in times of increased climate commitments and growing competition from renewables. The managing director of RWE at the time said(opens in new window) already in 2011 that he should not have started building the coal plant in Eemshaven.

They are now saddled with loss-making investments, and even though they could have foreseen this scenario years ago, they are seeking to shift the costs of their stranded assets to Dutch taxpayers. By allowing these companies to sue the Dutch state, the ECT is enabling companies to claim the loss of unfeasible future earnings. As a result, there is a risk that public money will be spent on compensation for unprofitable coal-fired power plants rather than on the development of renewable energy infrastructures. This seems even more perverse when considering the companies’ responsibility for the social and environmental costs that they have inflicted on society by climate change and air pollution.

These ECT cases set dangerous precedents and may impede member states’ coal phase-out strategies, as governments are now wary of introducing climate policy measures for fear of being sued, thereby creating a barrier to achieving emissions reductions targets and obligations. At the same time, ECT protection can disincentivize companies and shareholders from divesting from fossil fuels, knowing that they can resort to arbitration to obtain compensation for measures forcing them to do so. In the Netherlands, the ECT casts a shadow over ongoing compensation negotiations with the energy companies regarding a proposed legislative amendment(opens in new window) to the coal prohibition law. This amendment foresees a temporary production limitation of coal-fired power plants with the purpose of complying with the Urgenda-ruling, for which RWE has already demanded(opens in new window) full financial compensation.

Governments need to consider(opens in new window) terminating or withdrawing from the ECT in order to protect the much-needed policy space to phase out fossil fuels and to promote a fair and just low-carbon energy transition. This should happen in unison to avoid an absurd sunset clause from being triggered, under which the ECT would continue to apply for another twenty years after withdrawal. The coming two decades are crucial for the global energy transition. Governments must come together to take action and prevent investors from continuing to challenge and frustrate climate policies.

A draft version of the report has been shared with RWE, Uniper and Onyx. All three companies have declined to respond.

Do you need more information?

-

Bart-Jaap Verbeek

Researcher

Partners

-

Sarah Brown, Ember

-

Arjun Flora, IEEFA

Related content

-

Research undermines billion euro “compensation” claims by German energy companies for Dutch coal phase-outPosted in category:News

Research undermines billion euro “compensation” claims by German energy companies for Dutch coal phase-outPosted in category:News Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on: -

Coal company sues the Netherlands over controversial investment treatyPosted in category:NewsPublished on:

Coal company sues the Netherlands over controversial investment treatyPosted in category:NewsPublished on: -

Busting the myths around the Energy Charter TreatyPosted in category:News

Busting the myths around the Energy Charter TreatyPosted in category:News Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on: -

-

-

-

Shell pressured Nigeria with ISDS process to obtain oil field OPL 245Posted in category:News

Shell pressured Nigeria with ISDS process to obtain oil field OPL 245Posted in category:News Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on: