Blackstone as new landlord

How large investors are gaining ground on the Dutch housing market

For a number of years now, the housing crisis – the growing unaffordability and inaccessibility of housing – has been one of the most pressing political issues in several countries. Households are often ‘stuck’ and find it difficult to change homes when, for example, their personal circumstances change.

Although the cause of the crisis is often sought in the shortage of supply, the current crisis is also partly the result of financialisation. Due to a worldwide surplus of liquid financial resources, there is a growing amount of assets that must yield a return and must be managed. The so-called “unconventional” monetary policies of central banks are also forcing investors to take more risks. Against this exceptional background, institutional investors have become bigger players in residential real estate markets and Blackstone, a large asset manager with private equity funds, has also entered the Dutch residential market.

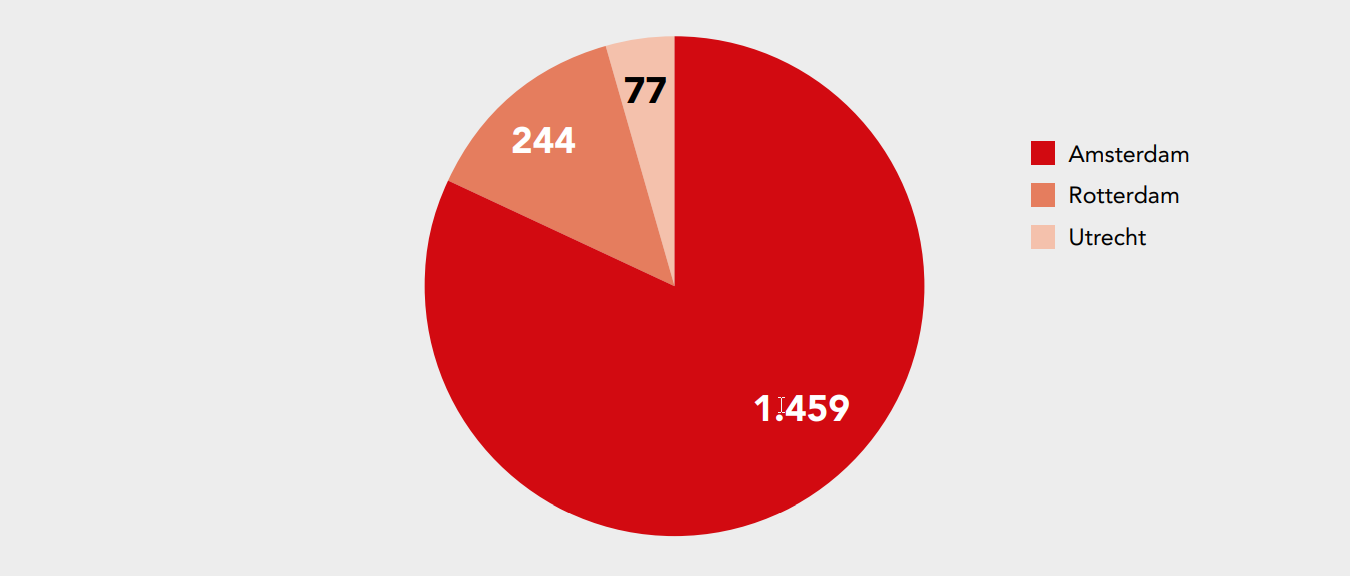

This research shows that, although the company is currently a small player in the Dutch residential market, it is financially strong and able to respond quickly to changing market conditions. Specifically for real estate, Blackstone has €40 billion in financial resources ready to deploy when the opportunity arises. They are competing with households that also want to buy a home. Moreover, although the company itself claims to play an important role in the refurbishment and renovation of properties, this research shows that Blackstone Property Partners Europe Holding (BPPEH), which owns the Dutch property, invested only € 53.5 million in maintenance and renovation in 2020. So for the time being, Blackstone is using the capital it raises primarily to buy up more properties.

Market conditions change much faster than regulations. To make the housing market more accessible – also for future generations – and to prevent institutional investors from owning a growing share of the housing stock in the future, regulation is needed now. To achieve this, the earlier liberalisation of the housing market must be reversed, rental protection must be strengthened and there must be a general obligation to live in your own home.

In the coming years, major investments will have to be made to insulate homes and make them more energy efficient. These investments must take place within a regulated framework with strict social and ecological conditions in which the rights of tenants are paramount and good quality housing at an affordable price is the starting point.

Please note: the report is in Dutch.

Do you need more information?

-

Rodrigo Fernandez

Senior researcher -

Ilona Hartlief

Researcher

Publication

Related news

-

The Netherlands: European champion share buybackPosted in category:Long read

The Netherlands: European champion share buybackPosted in category:Long read Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

-

Fintech’s red flags Published on:

Myriam Vander StichelePosted in category:Publication

Myriam Vander StichelePosted in category:Publication Myriam Vander Stichele

Myriam Vander Stichele