The deep fall of a global player

The crisis of Deutsche Bank and its perspectives

Deutsche Bank has been the pride of the German financial industry for many years. It was founded in 1870 and was an important financier during the period of German industrialisation. Already before World War I, the bank was a global player with important subsidiaries from Buenos Aires to Hong Kong, Singapore and Calcutta. Many German comments deploring the present crisis at the bank point to that tradition of 150 years.

What is mentioned less frequently is the role of the bank in the sale of Jewish properties, banks and firms that had been expropriated by the Nazis after 1938. It was a very profitable business, comparable to today’s mergers and acquisitions. In the early 1940s, Deutsche Bank contributed to finance Auschwitz, including the financing of IG Farben, the big chemical conglomerate, which produced Cyclone B for the gas chambers. After World War II, the US military government considered splitting up the bank. But with the emergence of the Cold War, these plans were given up.

In the following decades, Deutsche Bank became the core of what was called Germany Inc. – a symbiosis with the big players of German industry, such as Mercedes, BASF, Siemens, etc. At the time, Deutsche Bank had a seat on the board of 35 out of the 100 biggest German corporations and was one of the main financiers of post-war reconstruction, often mystified as the German Miracle.

Particularly ruthless gambling in the casino

However, from the 90s onward, Deutsche Bank started to integrate into the new type of globalised finance capitalism opened up by lifting the controls on capital movement and liberalisation through trade agreements, as well as encouragement by the German supervisor. It developed into an institute that was systemically important internationally and the biggest bank in the Eurozone. The investment division of the bank, whose main base was the London branch, became the gravitation centre for the new business model, and – until 2008 – also the profit centre. Under the chairmanship of Josef Ackermann, Deutsche Bank became a symbol for what many believed to be the benefits of globalisation. In the early years of the century, he set a target of 25% return on investment. Objections that pursuing such a target would only be possible at the expense of the real economy, financial stability and society were defamed as ideology.

On 20 June 2007, at the time that the subprime crisis in the US had already begun to emerge, Ackermann declared at a SPD conference that after the Asian crises of 1998, “financial markets have become much more stable.” The reasons for this stability were “wise politics” along with “the use of innovative financial instruments and the emergence of new actors who allow for a better distribution of risks. We are talking about instruments such as derivatives and securitization.” Although just the contrary has happened, Ackermann remained in office until 2012. The bank was one of the main beneficiaries of the payout by the US authorities during the 2007-2008 financial crisis.

Although Ackermann’s hubris never materialised, he was hailed as a shining hero. He was very agile in politics and lobbying, e.g. as chairperson of the International Institute of Finance, a global lobbying association. He had contacts with the then finance minister in the Social Democrat-Green government, Hans Eichel, who was proud to have dinner with him once a week. Later on, after Merkel had become Chancellor, she organised a birthday dinner for the banker in her office. Only after rumours about the criminal practices of Deutsche Bank stated appearing did she stop this drastic example of the collusion between finance capital and politics.

Criminals in twin-stripes

The popular talk about banksters is often qualified as polemics. In the case of Deutsche Bank, it is an absolutely adequate description. The fines, compromise settlements and mandatory compensations the bank has had to pay since 2009 amount to almost € 20 billion. Among the offenses committed by the bank are the manipulation of the Libor and the Euribor (together with most other European and US big banks), money laundering, tax fraud, manipulation of interest swaps, credit default swaps and other derivatives, fraudulent acquisitions by false pretences of public guarantees and illegal practices with mortgages. The bank is also one of the culprits revealed by the 2013 Offshore Leaks and the Luxemburg Leaks.

However, the most spectacular case is still underway. On 16 September of this year, the US Ministry of Justice filed a claim of over $ 14 bn. (€ 12.5 bn.) due to illegal methods in the bank’s US mortgage business before the crisis. Although the bank is already keeping € 5 bn. in reserve for future lawsuits, having to pay the full amount in the US claim would probably lead to its collapse.

At present, negotiations between the bank and the US administration on reducing the amount are taking place behind closed doors. The US knows, of course, that a collapse of Deutsche Bank would trigger a chain reaction and lead to another global crisis, so a reduction of the fine can be expected. It will probably be sufficient to prevent substantial contagion, but at the same time, it will be enough to end Deutsche Bank as a global competitor for its US rivals.

Economic shrinking

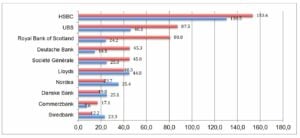

Along with the juridical threats comes an economic downturn. Deutsche Bank shows poor performance in practically all indicators. Between 1 January 2006 and 29 September 2016, its value on the DAX (German stock market) has fallen from € 45.3 bn. to €14.5 bn. This is a decline of 67.9% (see graph 1). Only the Royal Bank of Scotland has performed worse, with a decline of 70%. (All figures here(opens in new window) ).

Graph 1: Value of major EU banks – 01.01.2006 & 29.09.2016 (in bn. €)

The market value of its shares has fallen by 90% since June 2007, and is teetering at present between € 12 and 15 bn. The same thing happened with the dividends. While in 2007, just before the crash, shareholders received a 3.92% dividend for each Deutsche Bank share, in 2015 the rate was at zero.

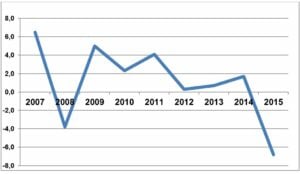

The biggest problem, however, is its level of profitability, which is constantly declining, as the following graph shows. This, again, is a general problem of banks in the EU, particularly compared to those in the US. The new regulatory burden is often blamed, but here again, the performance of Deutsche Bank is particularly bad, because it had abused many strategies which are now more regulated. Lack of confidence has also resulted in clients withdrawing their money from the bank.

Graph 2: Profitability of Deutsche Bank 2007 – 2015 (in bn. €)

The underlying problem is that the EU banks still have not really overcome the 2008 crisis. According to the IMF, some 25% of these – in the Eurozone, even 30% – have to change their business model if they want to survive under the present environment of low or zero interest rates, stagnating growth and political uncertainty.

Will Deutsche Bank collapse?

In June 2016, the IMF(opens in new window) warned that Deutsche Bank posed the greatest risk to the global financial system. In October, the UK supervisor, the Bank of England, required UK lenders to explain their exposure to Deutsche Bank in order to be able to act in a worse-case crisis or collapse.

However, it is very unlikely Deutsche Bank will collapse. It will shrink and change. But before the bank’s trouble runs out of control, big German transnational corporations and – as a saviour of last resort – the government will come to rescue it, in spite of promises that taxpayers will no longer have to foot the bill for failed banks.

“The German industry needs a German bank that accompanies us out into the world,” said Jürgen Hambrecht(opens in new window) , the chairman of BASF, the n°1 chemical corporation worldwide. And his colleague from Siemens, Joe Kaeser, declared(opens in new window) : “The management has set the right targets and has our full confidence.” In case of a serious danger of bankruptcy, a consortium of German transnational corporations will be established to prevent the worst case from happening. Because Deutsche Bank is still too big to fail. International rules on the resolution of systemically important banks in the case of a collapse still have not yet been set up. This reflects, of course, the failure of financial reforms since 2008. But the German economy is also big enough to afford a rescue operation, if necessary.

Berlin has played the arrogant schoolmaster in terms of Eurozone crisis management. This has stirred – rightly – a lot of criticism. Now, there is – again rightly – a lot of schadenfreude about the disaster of Deutsche Bank. But any fears – or hopes – that this might have dramatic consequences are probably unfounded.

Do you need more information?

-

Myriam Vander Stichele

Senior Researcher -

Jasper van Teeffelen

Researcher

Partners

-

Peter Wahl

Related news

-

Why share buybacks are bad for the planet and peoplePosted in category:Opinion

Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: Myriam Vander Stichele

Myriam Vander Stichele -

The Netherlands: European champion share buybackPosted in category:Long read

The Netherlands: European champion share buybackPosted in category:Long read Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

The trillion-dollar threat of climate change profiteersPosted in category:Long read

The trillion-dollar threat of climate change profiteersPosted in category:Long read Myriam Vander StichelePublished on:

Myriam Vander StichelePublished on: