Shell’s reckless divestment from Niger Delta

Shell’s divestment must be halted until clean-up and decommissioning are addressed

Summary

- Shell is leaving widespread historical oil pollution across the Delta

- Abandoned infrastructure and inadequate funds for decommissioning – ‘a ticking time bomb’

- Shell is selling to a complex maze of investors, some of which are unstable and face financial difficulties

Shell cannot be allowed to divest from the onshore oil industry in the Niger Delta before it takes responsibility for its toxic legacy of pollution and the safe decommissioning of abandoned oil infrastructure.

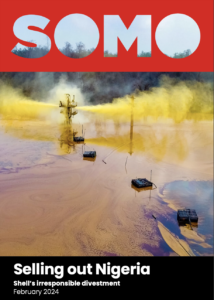

The oil giant is leaving behind petroleum-contaminated rivers and streams and large areas of polluted land that have devastated the lives and livelihoods of millions of people living in the Niger Delta. Shell claims it cleans up, but our new report ‘Selling Out Nigeria – Shell’s irresponsible divestment’ released today shows how historical pollution remains a serious issue and how Shell is trying to avoid responsibility for this despite the billions of dollars it has earned from the oil. The certification process Shell uses to claim it has cleaned up oil spill sites is ‘deeply flawed and cannot be relied upon’.

While Shell has long maintained that theft of oil and interference with pipelines are the causes of much of the oil pollution – claims that are strongly contested – this has no bearing on its responsibility to clean up. Under Nigerian law, Shell must clean up oil spills no matter the cause. It has failed to do so.

The long-term oil pollution is bad enough, but the situation is likely to worsen in the years to come with a massive unpaid bill for safely decommissioning old and dilapidated oil infrastructure.

Shell’s “ultimate Houdini act”

Scattered across the landscape of the Niger Delta are abandoned pipelines, well heads and other oil infrastructure that are a disaster waiting to happen. All of Nigeria’s oil infrastructure will ultimately have to be safely decommissioned, but the investigation by SOMO shows that Shell has divested to many newly created companies that do not appear to have the funds or willingness to do this.

There is a massive transparency gap around the issue of funding for decommissioning. Nigeria has legal requirements for companies to set aside funds for decommissioning, but there is no means to establish how much funding companies have – or have not – set aside. Available indicators are worrying – researchers could not find any confirmation that Shell has set up a fund or funds to cover the decommissioning of the oil mining leases (OMLs) it has sold.

Shell has pulled off the ultimate Houdini act. As the oil industry enters its final phase, whether that’s in the next 5 years or 25, Shell has sold its toxic assets and will not be left holding them when the music stops. Shell has profited from oil extraction for decades and in doing so, has made the Niger Delta one of the most oil-polluted places on earth, leaving communities to face the dire consequences that will remain well beyond the lifetime of the industry.

Shell is not the only international oil company exiting the onshore Niger Delta. All of the European and US oil majors are also leaving. However, the departure of Shell, which has been the dominant operator with the largest footprint in the region for decades, impacts significant areas of the Delta and thousands of communities.

Shell must not be allowed to simply walk away from this most emblematic of unjust energy transition cases. Ensuring that the historical pollution, the lack of funding for safe decommissioning and poor financial transparency are fully addressed in Nigeria will be an important litmus test for a just energy transition across the world.

A complex maze of investors and buyers

Despite claiming to divest responsibly and claiming it conducted due diligence on the new buyers (most of which are Nigerian oil companies), the report exposes how Shell has sold to newly created companies that have – in some cases – little real substance, opaque backgrounds or involve complex groups of domestic and foreign investors.

We found that some of the new companies appear to be crude investment exercises, backed by investors who appear to have no interest in the situation of the Niger Delta and only in making as much money as possible while they can.

Some of the companies that bought the oil assets seem to have set themselves up to extract Nigeria’s last remaining oil wealth and are likely to simply fade away when oil ceases to be profitable.

Our report also found that while Shell has offloaded its problem assets, it is still involved financially in some of the new operations. Shell has loaned funds to several of the new companies or will buy the oil they produce.

The links are not only financial. In announcing the sale of its wholly-owned Nigerian subsidiary, the Shell Petroleum Development Company (SPDC), Shell has said it will retain a role in supporting the management of SPDC Joint Venture facilities that supply a major portion of the feed gas to Nigeria LNG (NLNG). Shell holds a 25.6 per cent interest in NLNG.

New principles for responsible oil and gas divestment

The international oil companies are divesting at an accelerated rate – and the report highlights that the process is inadequate. There will be no ‘just energy transition’ under this regime.

In response to the growing concerns about how international oil companies are divesting from the onshore Niger Delta, civil society organisations in the region, including Stakeholder Democracy Network (SDN), have formulated new principles for responsible oil and gas industry divestment, which they hope the Nigerian Government will adopt and implement.

The principles would help ensure a transparent process to assess the capacity of the incoming companies, with meaningful community consultation throughout, address environmental pollution, and deteriorating and abandoned infrastructure.

Do you need more information?

-

Audrey Gaughran

Executive Director

Related news

-

-

The unclean getaway: how international oil is exiting the Niger DeltaPosted in category:Opinion

Audrey GaughranPublished on:

Audrey GaughranPublished on: Audrey Gaughran

Audrey Gaughran -

Nigerian communities can bring landmark human rights claims against Shell, High Court rulesPosted in category:News

Nigerian communities can bring landmark human rights claims against Shell, High Court rulesPosted in category:News Audrey GaughranPublished on:

Audrey GaughranPublished on: