Many years of research by SOMO pays off

After years of social pressure, the Dutch government recently admitted* that its tax policy, including tax treaty policy, is harmful to many people, countries and companies worldwide.

SOMO has played an important role in recent years by publishing numerous reports about tax avoidance. Researcher Rodrigo Fernandez represented SOMO on September 12 at a hearing in the Lower House. Meanwhile, the House has announced several measures.

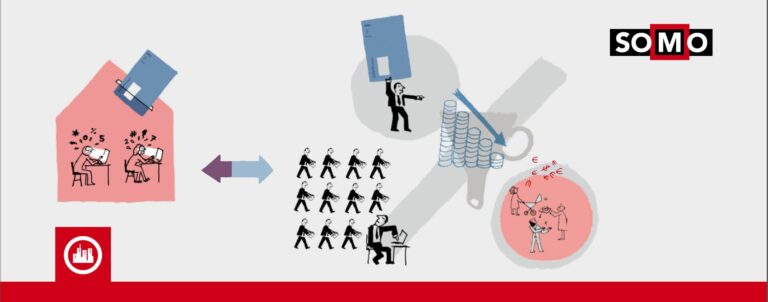

Studies by SOMO have shown that large multinationals establish so-called “mailbox” companies in the Netherlands and use them to channel payments to tax havens. Every year, € 4,000 billion flows through these companies – thirteen times our gross national product**. But these investment flows have little to do with the real Dutch economy. Moreover, the money that flows through these companies results in a direct loss of tax revenue for other countries, especially developing countries, which lose billions of Euros. This is unacceptable and must change, Rodrigo Fernandez told the Lower House.

New approach

The Ministries of Finance and Development Cooperation have announced they will join forces to reduce tax avoidance in the Netherlands. First, the ministries intend to do pioneering work at the international level in the fight against tax avoidance. Second, the government will implement a number of changes at the national level. The simultaneous implementation of a national and international approach marks an important change. Politicians, including State Secretary for Finance, Frans Weekers, have long maintained that national measures are unnecessary and affect our international competitiveness. But according to SOMO and its colleagues from the Tax Justice Network(opens in new window) , the government has plenty of options and has a moral duty to take action.

Measures

One such measure is the government’s proposals to include anti-abuse provisions in bilateral tax treaties with twenty-three developing countries. The study Should the Netherlands Sign Tax Treaties with Developing Countries? (June 2013) shows that Dutch tax treaties lead to a total annual revenue loss of € 554 million for 28 countries(opens in new window) , because the money disappears through Dutch mailbox companies. This conservative estimate – only losses on dividends and interest flows are included – illustrates the need for anti-abuse measures. SOMO would therefore prefer that all tax treaties contain anti-abuse provisions. In addition, SOMO believes that the prevention of double taxation (the original purpose of these treaties) should take place within a multilateral framework.

Shadowy agreements with tax authorities

We are not there yet. All “mailbox” companies that want to make arrangements with the tax authorities should meet stringent requirements with respect to their real activities in the Netherlands, so-called substance requirements. This is still not sufficiently addressed in the government’s proposals. The untransparent agreements between the tax authorities and individual companies, the so-called ‘tax rulings’, should be made public. SOMO’s most recent research Avoiding Tax in Times of Austerity(opens in new window) (September 2013) has shown how easy it is for a “mailbox” company to make arrangements with the tax authorities that lead to double non-taxation of income. Fortunately, the European Commission has announced that it plans to investigate this issue. SOMO’s research made the Portuguese evening news(opens in new window) .

Human rights violations

The government should also be promoting transparency by requiring that ‘beneficial owners’ of a company must be publicly known. These are the people who ultimately receive the money. SOMO’s report Private Gain, Public Loss (July 2013) showed the risks associated with a lack of transparency: human rights violations, money laundering, corruption and other illegal business. The Dutch government and the public have no idea what the “mailbox” companies are used for.

Perseverance pays off

Whether government proposals for a fairer tax system will succeed will depend on the way the measures are implemented and enforced. Yet SOMO is excited about the current impact of its investigations. “In 2007, when SOMO published its first report on how the Netherlands facilitates tax avoidance, it was simply ignored by the then government”, says researcher Indra Römgens. “Now it finally seems that our research and perseverance are paying off. We are proud of that.”

SOMO will ensure that the subject continues to receive attention in future, especially in current times of crisis and austerity. As the OECD spokesman at the hearing aptly said: “Tackling tax avoidance is not a wish, but a necessity“.

* Read more(opens in new window)

(in Dutch only)

**These figures are for 2011. Source: DNB(opens in new window)

(in Dutch only)

Do you need more information?

-

Rodrigo Fernandez

Senior researcher

Related content

-

-

-

-

Fifty shades of tax dodging Published on:

Indra RömgensPosted in category:Publication

Indra RömgensPosted in category:Publication Indra Römgens

Indra Römgens

-

-

The Netherlands – still a tax haven Published on:

Arnold MerkiesPosted in category:Publication

Arnold MerkiesPosted in category:Publication Arnold Merkies

Arnold Merkies