Dutch efforts to combat letterbox companies have no effect

(according to figures from the Dutch Central Bank)

The new Dutch government, installed in October last year, claims it wants to get rid of the international reputation of the Netherlands as a tax haven. Previous governments also introduced measures to combat the abuse of letterbox companies in the Netherlands. There are over 14,000 of these letterbox companies in the Netherlands, which are used by multinational corporations for tax dodging.

In spite of these claims, the financial flows through Dutch letterbox companies have actually increased over the past ten years. This shows that the claims and policy measures taken by the government amount to little more than lip service, and that real changes are necessary if the Dutch government is serious about tackling the role of the Netherlands in corporate tax dodging.

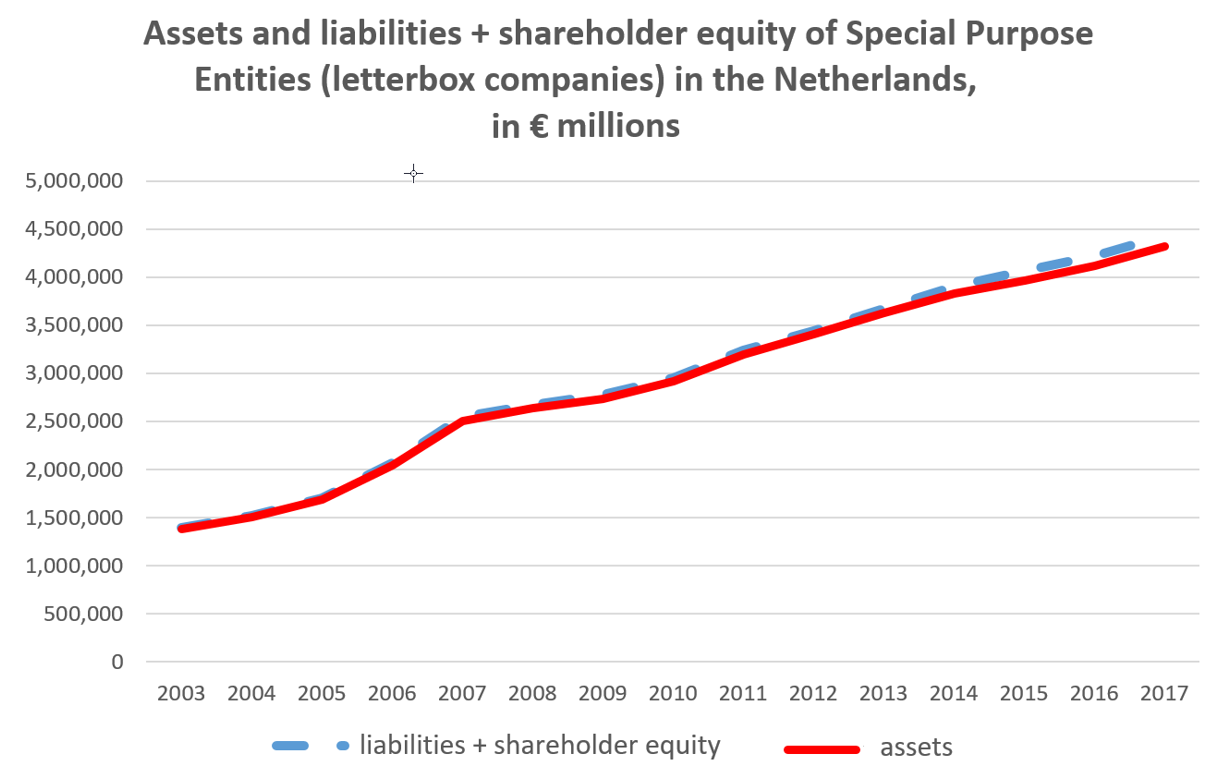

Balance sheet totals of Dutch letterbox companies set to break through €4,500 billion mark in 2018

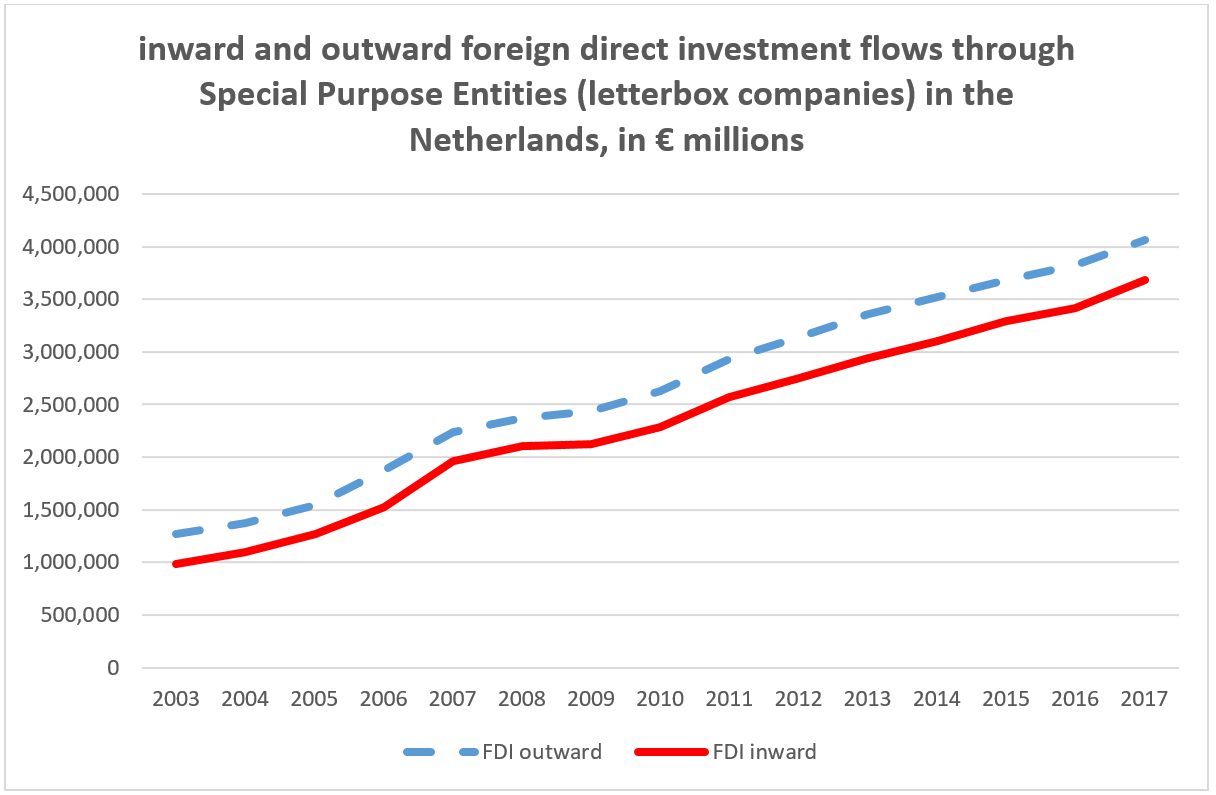

The most recent figures of the Dutch central bank (De Nederlandsche Bank, DNB) paint a alarming picture. Flows of foreign direct investment (FDI) through Dutch letterbox companies (technically referred to as Special Purpose Entities, or SPE’s) have increased by 75% since the beginning of the financial crisis in 2008. After a brief stagnation at the onset of the crisis, the figures increase year after year. Figure 2 shows that, without immediate policy changes, both the assets and the liabilities + shareholder equity (the balance sheet totals) will most likely break through the €4,500 billion mark this year.

Figure 1

Photo: Rodrigo Fernandez

Photo: Rodrigo FernandezFigure 2

Photo: Rodrigo Fernandez

Photo: Rodrigo Fernandez

Research by the University of Amsterdam(opens in new window) already showed last year that the Netherlands is the world’s biggest conduit country, used for channelling funds to offshore tax havens. IMF numbers(opens in new window) also show that the Netherlands, due to letterbox companies, is the world’s number one country in terms of investment flowing into the country, ahead of much larger economies like the USA, China and Germany. These letterbox companies are located in the Netherlands because of a range of Dutch tax policies (such as the huge Dutch tax treaty network) which enable companies to reduce their tax base, and the ease with which they can set up a letterbox company in the Netherlands to take advantage of these policies without having any real economic presence or activities in the country. The figures presented in these graphs clearly show the Netherlands’ key role in international tax dodging.

What needs to change?

The numbers show that the role of the Netherlands as a conduit country for multinational corporations is still increasing. This demonstrates that the Dutch government’s efforts to tackle letterbox companies has so far proven ineffective. The government needs to improve its substance requirements so companies cannot set up a letterbox companies without having any real economic presences or activities in the Netherlands. Furthermore, the government needs to more frequently critically evaluate the effect of these policy measures on capital flows, to ensure that policy measures are not just effective on paper, but are having an actual impact in reality.

Do you need more information?

-

Rodrigo Fernandez

Senior researcher

Related content

-

Katrin McGauranPosted in category:Publication

Katrin McGauranPosted in category:Publication Katrin McGauran

Katrin McGauran

-

EU’s secret ’sweetheart’ tax deals with multinational corporations soar to record numbersPosted in category:NewsTove Maria RydingPublished on:

EU’s secret ’sweetheart’ tax deals with multinational corporations soar to record numbersPosted in category:NewsTove Maria RydingPublished on: -

Mining taxes Published on:

Vincent KiezebrinkPosted in category:Publication

Vincent KiezebrinkPosted in category:Publication Vincent Kiezebrink

Vincent Kiezebrink

-

-

Europe leads the race towards a 0% corporate tax ratePosted in category:News

Europe leads the race towards a 0% corporate tax ratePosted in category:News Jasper van TeeffelenPublished on:

Jasper van TeeffelenPublished on: