The Netherlands lags further behind in tackling tax avoidance

It’s up to Greece to tackle its own problems with tax avoidance. This is what the Dutch government had to say in its response to the Fool’s Gold report which was released on Monday. The publication reveals how the Canadian mining corporation Eldorado is using mailbox companies to avoid paying taxes. The government’s reaction leaves no doubt that the Dutch authorities refuse to take responsibility for the pernicious effects of its own tax policies. The country is increasingly isolating itself from the European struggle against tax avoidance.

It was also on Monday that the European Parliament’s special committee on tax rulings in the EU first spoke to the European Commission. Pierre Moscovici, the European Commissioner who deals, among other issues, with tax affairs, was grilled by various MEPs. Fabio de Masi, member of the special committee, asked Moscovici whether he knew about the Eldorado research.

Mr. de Masi also stated: “I believe Commissioner Moscovici should address Jeroen Dijsselbloem who is chair of the Eurogroup which keeps imposing austerity measures on Greece. At the same time, Dijsselbloem is also Minister of Finance of the Dutch tax haven through which Greece and many other countries are deprived of rightfully due tax revenues. The Netherlands and the EU have a joint responsibility to tackle tax avoidance and have to stop hypocritically prescribing policies leading to economic depression while betraying the principle of sincere cooperation between EU member states.”

Hypocrisy of the Netherlands

The issue was also discussed today during the launch of SOMO’s Fool’s Gold report in Athens. Vice-chair Eva Joly of the special committee on tax rulings mentioned above, stressed that same point: “To call this hypocrisy is to put it mildly. It is time that Dutch citizens realise how their governments have, for decades, been defending this kind of robbery at industrial scale”.

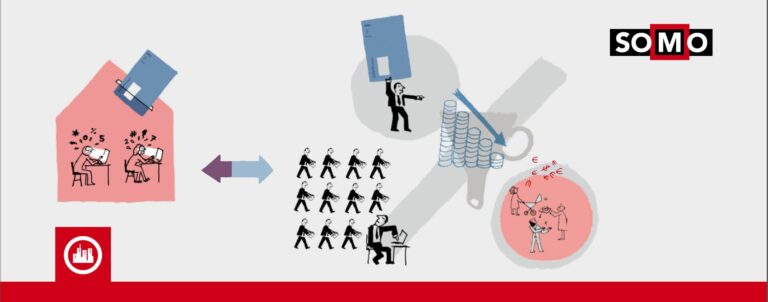

The report ‘Fool’s Gold’ proves that Greece’s economic recovery is being undermined by tax avoiding practices carried out through mailbox companies in the Netherlands. In 2012-2013, for instance, the Greek government lost € 1,7 million to the Canadian gold mining firm Eldorado Gold. The corporation was using the Netherlands as a conduit to shift its interest income to Barbados, so as to avoid paying taxes. The company has a number of gold mines in Greece which are controversial for damaging the environment and causing human rights abuses.

Structural problem

The report by SOMO shows that Eldorado’s practices are far from being an exception; the problem is indeed structural. Dutch mailbox companies – well-known as instruments for fiscal avoidance – are used by other companies for their investments in Greece: BMW, Coca-Cola, Bosch, Dole and Footlocker, to mention a few. SOMO advocates raising the issue of the Netherlands’ double standards.

European member states can jointly ensure that profits do not remain untaxed and wind up in tax havens. In order to achieve this, they must prioritise a fair tax system instead of engaging in a destructive race-to-the-bottom in the area of corporate tax. At the same time, more fiscal transparency is also needed, and it should be more far-reaching than the recently presented ‘Tax Transparency Package’ drafted by the European Commission. What transparency means is obviously openness to everyone, not just tax authorities. The case of Eldorado illustrates a structural problem, and shows why it is so important to grant NGOs, unions, journalists and many others access to this information. As long as tax avoidance persists in the EU, the more watchdogs the better.

Related content

-

Crisis-ridden Greece hit by tax avoidance through the NetherlandsPosted in category:NewsPublished on:

Crisis-ridden Greece hit by tax avoidance through the NetherlandsPosted in category:NewsPublished on: -

-