The ‘Minerals-Energy-Finance Transition’

The unremitting search for a sustainable and affordable energy supply, the disastrous social and ecological impact of large-scale mineral extraction and electricity generation, continuing financial instability and the growing gap between rich and poor – these are some of the most critical challenges and crises facing the world at the moment. However, the connections and interplay between these seemingly disparate issues often remain underestimated or are too complex to analyse.

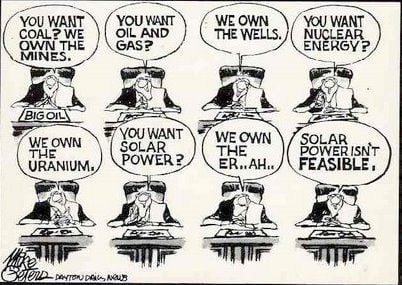

SOMO’s new ‘Minerals-Energy-Finance Transition’ (MEFT) programme employs a systems approach to explore the dynamics through which the large-scale, corporate-dominated mining, energy and financial industries interact in a system of energy provision, natural resource exploitation and wealth and power accumulation that is unsustainable and undemocratic.

By exposing and documenting how this Minerals-Energy-Finance Complex functions, the MEFT programme aims to identify alternatives and pathways to transform the current system and enable a transition to a sustainable, democratic system of energy provision and wealth and natural resource management.

A complex of conflicting and overlapping interests

In countless locations and countries around the world, the mining and energy industries are mutually and inextricably dependent on each other: mining operations cannot proceed without a massive supply of electricity delivered by the energy company, most often through hydroelectric mega-dams or large scale fossil-fuel based power plants. Conversely, the energy companies primary customers in these situations and their raison d’être are often large-scale mining operations and/or mining-related industries (such as smelting). Both industries are dependent for funding on public and private financial institutions, which are in turn dependent on the success of both the mining and energy operations for a return on their investment. The conflict of interest is apparent even at the personal level: numerous individuals holding important positions (such a board membership or executive functions) in companies involved in mining in a particular area also simultaneously fulfil important positions in the energy company involved in the project and/or in the projects financiers. The MEF Complex frequently involves a mix of state and private actors, including large multinational corporations. All of this reinforces a system of accumulation in which power and resources are concentrated in the hands of a few individuals and a select segment of the economy.

A widening governance gap

New normative standards on human rights such as the OECD Guidelines and UN Guiding Principles make it clear that all of the various private and state-owned companies involved in the MEF Complex are responsible for the adverse social and environmental impacts resulting from any one of the industrial activities in the Complex. This applies even if a particular actor does not itself cause the impact. Despite these normative developments at the international level, an acute governance gap remains, and is in many ways growing wider. The complex web of interests and relationships means that the parties who are responsible for and profiting from the Complex’s adverse impacts can point the finger at each other and shirk responsibility. The ‘strategic importance’ of energy supply and finance corporations that are ‘too big to fail’ mean that regulators and , even those with the political will and capability, are unable to sufficiently hold the parties accountable for their actions and impacts.

SOMO’s MEFT programme

The existence of the MEF Complex has major implications for the functioning of the global economy, respect for basic human rights, and the health of the climate and ecosystems around the world. SOMO’s MEFT programme seeks to untangle the complex web of interests and impacts by clarifying and analysing how and why the MEF Complex functions. The MEFT programme integrates investigations being conducted by SOMO partners in Latin America, Africa and Asia with an overarching analysis conducted by SOMO. Field studies into mining projects and energy facilities are being combined with a theoretical systems approach analysis and insights into the financial world. The overall aim of the programme is to contribute to the transition from the current unsustainable, undemocratic system of energy provision, natural resource exploitation and wealth and power accumulation into a transparent, democratic and sustainable system of energy provision and wealth and natural resource management.

MEFT expert meeting in October 2014

In order to continue to define and dissect the complex web of actors and interests at play within the Minerals-Energy-Finance Complex – in Brazil and around the world – and identify pathways and pressure points for affecting a sustainable transition, SOMO is organizing an expert meeting in Amsterdam in October 2014. The aim of the meeting is to facilitate knowledge exchange on MEFT-related issues, identify relevant actors and processes, elaborate and refine intervention strategies, and set priorities regarding the MEF transition process. Further information about the expert meeting will be made available in the coming months, but interested individuals and organizations are encouraged to contact SOMO Senior Researcher Joseph Wilde-Ramsing at j.wilde [at] somo.nl.

Case in point: The Belo Monte Hydroelectric Dam in Brazil

In her Master’s thesis, entitled ‘Whom to damn for the damage of dams? A normative-empirical analysis of corporate relationships and responsibilities within the Brazilian and Peruvian Minerals-Energy Complex’(opens in new window) , SOMO intern and University of Utrecht researcher Karlijn Kuijpers conducted a detailed analysis of the MEF Complex in a small number of quantitative case studies in Latin America. The notorious Belo Monte Dam currently under construction in Brazil is a powerful example of the conflicts of interest present in the MEF Complex and the adverse impacts of the Complex for people and planet. In the Brazilian Amazon, the mining of various commodities is currently being expanded. In order to satisfy the energy-intensive mining industry’s growing demand for electricity, the Xingu River is being dammed to construct the Belo Monte hydroelectric power plant. Vast tracts of land behind the dam will be flooded, and the course of the river will be dramatically diverted. This will result in significant adverse impacts on the local indigenous population, which depends on the river for food and transport, as well as on small-scale farmers, who have already seen their land expropriated. Although they are bearing the brunt of the adverse impacts, local communities complain that they have enjoyed few of the economic benefits of the mining operations, all of which are owned by large, multinational corporations. Similarly, the communities fear and expect that they will enjoy few, if any, of the positive benefits from the power plant, which will primarily supply the industry.

In addition to the range of multinational energy and mining corporations with a role in the project, the Brazilian state also has a significant finger in the pie as many of the companies involved in the construction and operation of the Belo Monte power plant are state-owned enterprises. More importantly, the Brazilian development bank, BNDES, is financing the entire project with taxpayer money through the largest loan in its history. Click here(opens in new window) to read more.

Do you need more information?

-

Joseph Wilde-Ramsing

Advocacy Director

Related content

-

-

Overconsumption of transition minerals will cost us the earthPosted in category:Opinion

Alejandro GonzálezPublished on:

Alejandro GonzálezPublished on: Alejandro González

Alejandro González -