How much of Shell’s 2022 record profits will be registered in tax havens? Probably quite a lot.

Shell announced it made a record, eye-watering, $39.9 billion profits in 2022, as the world is facing multiple global crises. Analysis of Shell’s tax transparency reports over the past several years show that a substantial amount of the company’s profits are registered in tax havens, including the Bahamas and Switzerland. Considering Shell’s consistent use of tax havens, it appears evident that part of Shell’s $39.9 billion profits announced on February 2nd, are thanks to aggressive tax planning and use of tax havens.

In this article we show how Shell uses tax havens and what this could mean for its 2022 profits. The findings make clear that Shell needs to immediately end its use of tax havens and pay its fair share in tax.

In 2018 Shell started publishing an annual Tax Contribution Report, showing how much profit it makes in each country it is active, and how much tax it pays. Analysis of these reports show that tax havens play a key role in the oil giant’s global corporate structure. While Shell claims it is reducing its presence in tax havens, and has done so in some cases, it was still making use of some of the world’s worst tax havens as of 2021. Shell states that it is present in low-tax jurisdictions not to avoid taxes but for commercial reasons, including activities such as oil trading, holding investments, insurance and financing. However, by locating these activities in low-tax jurisdictions, Shell can use these tax havens to shift profits, and significantly limit the taxes it owes on its global profits.

Shell has key treasury and regional trading operations in offshore financial centres and tax havens including The Bahamas, Singapore and Switzerland. These countries are ranked among the worst tax havens in the world according to Tax Justice Network’s 2021 Corporate Tax Haven Index(opens in new window) .

Barring a major change in Shell’s fiscal practices since 2021, it is likely that large parts of Shell’s 2022 record high profits will also have been registered in the same tax havens as before. By looking at Shell’s use of tax havens in 2021 and earlier years we can gain insight on where part of its 2022 profits will likely have been registered. In the following section we give a brief overview of Shell’s global presence in tax havens based on the most recent available information. Shell publishes its Tax Contribution Reports about a year after the book year, so the report concerning its 2022 profits is not yet available. All information below is therefore based on the most recent available information, the 2021 Tax Contribution Report(opens in new window) Shell published in December 2022.

Shell’s use of tax havens

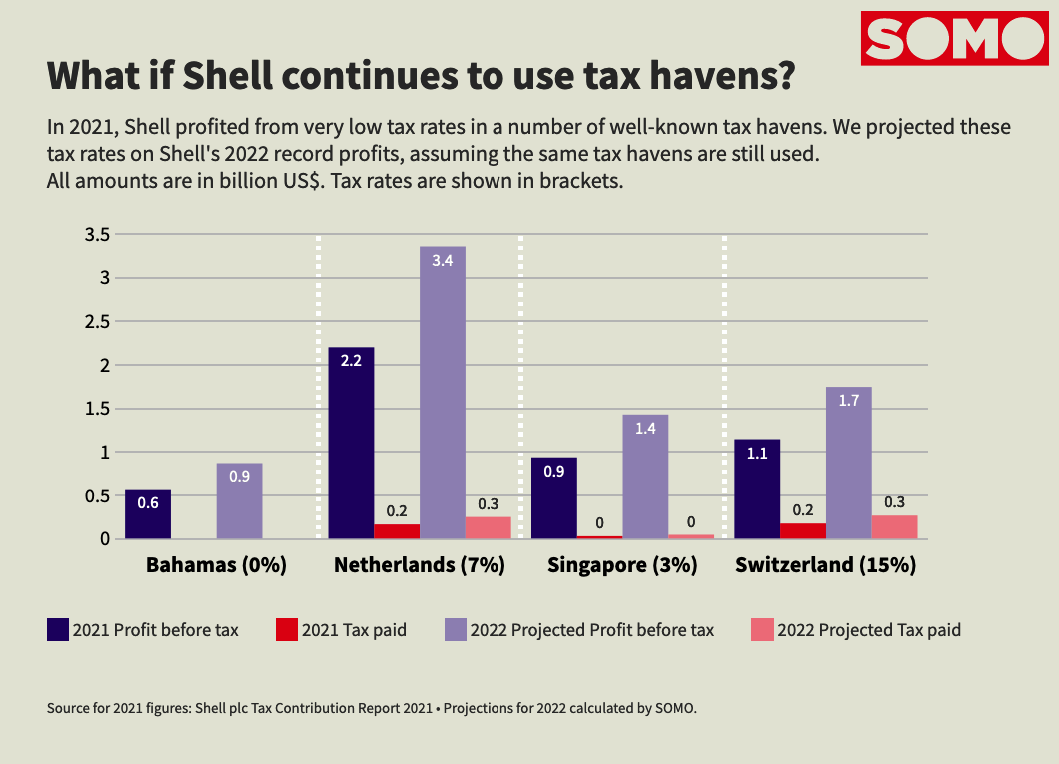

In 2021, Shell recorded large parts of its profits in tax havens where it enjoyed very low effective tax rates. The effective tax rate is calculated by dividing the tax paid by the pre-tax profit. Shell recorded high profits in the Bahamas (US$ 570 million profits, entirely tax-free), Singapore ($937 million profits, 3% effective tax rate), Switzerland ($1.1 billion profits, 15% ETR), and the Netherlands ($2.2 billion profits, 7% ETR).

To put these amounts into perspective, Shell’s average global ETR in 2021 was 30.8%. It registered $1.4 billion profits in Nigeria (34% ETR) and $1.1 billion in Norway (53% ETR), two countries where the company operates major oil and gas fields. It is important to note here that Shell’s average global effective tax rate is inflated because of the often higher tax regimes for oil and gas extraction. So Shell can use the relatively high amount of taxes paid in countries like Norway and Oman to create the suggestion that it pays a lot of tax, while it actually makes avid use of tax havens to avoid taxes and its effective tax rate in many countries is very low.

Switzerland and The Bahamas appear to be purely used by Shell as tax havens. The company has no ‘real’ economic activity in either country.

Shell has registered 15,000 of its trademarks in a single corporate entity in the Swiss canton of Zug, a renowned low-tax jurisdiction where Shell is subject to 12% income tax. From Zug it licenses these trademarks, receiving royalty payments from Shell affiliated entities across the world which end up in the tax haven. In addition to trademark licensing, Switzerland is also the location of Shell’s principal insurance company. Shell employed 111 staff in Switzerland in 2021, and generated an average profit per employee of about $10 million. This is very high in comparison to the global average profit per Shell employee, which was only $320,000.

The Bahamas is the base of Shell’s West Africa and Latin American trading office. The company had 35 employees in the Bahamas in 2021 and generated $571 million in profits. This means Shell generated approximately $16 million in net profit per employee in The Bahamas.

In Singapore Shell has real activities of economic substance, such as refineries, and 3,617 employees. However, it is also home to the company’s regional trading companies, treasury centres and other financial services (such as group lending entities). Singapore is the base of Shell’s regional Asia-Pacific treasury operations (including group lending entities), pension fund management, as well as trading business. Due to tax exemptions and the low-tax regime in Singapore for treasury activities, Shell barely pays tax in the country. It had a 2% average effective tax rate between 2018-2021, while registering billions of profit in the country.

The Netherlands was still Shell’s headquarters in 2021, where it had over 8,000 employees, operating a refinery, gas fields and housing key corporate divisions. The Netherlands also acts as a financial centre for trading, holding and treasury activities. The Netherlands is a tax haven for Shell, with the company in 2019 finally admitting that it pays no corporate income tax in the country. Thanks to the Dutch tax system and its beneficial treatment of head offices (including allowing tax deduction of global liquidation losses, a lack of withholding taxes and a participation exemption), Shell can use the Netherlands as the low-tax destination for its global profits. Similarly, in the United Kingdom Shell has also not paid income tax in years by deducting investments and losses from its profits. By moving its head office from the Netherlands to the UK in 2022 its tax treatment in the Netherlands will likely change and Shell will register less profits as a result.

In addition to these tax havens, Shell also has substantial presence in the United Arab Emirates, another tax haven. Similar to Singapore and the Netherlands, Shell has substantial economic activities in the UAE, having oil extraction licences there, in addition to its regional trading centre. While the UAE levies relatively high taxes on Shell’s petroleum operations, the majority of Shell’s revenue in the country is generated by downstream activities such as sales, marketing and trading. These are exempt from taxation in the UAE. So, while Shell recorded $442 million profits in the UAE in 2021 over which it paid a 38% effective tax rate, large parts of its UAE profits were, in reality, untaxed. This is better reflected in the figures reported by Shell for 2019 and 2020, when its effective tax rates in the UAE were respectively 6% and 7% (see tables below).

What this could mean for Shell’s 2022 record profits

We can conclude from the above and the table below that it has been standard practice for Shell over the past four years to register large amounts of profit in low-tax jurisdictions. In 2019 and 2020 Shell carried out a ‘review’ of its entities in low-tax jurisdictions and has stated it will continue to do so every year. As a result, Shell has ended some activities in certain tax havens. It moved its lending activities from Bermuda to the Netherlands and the UK, and has also moved its Swiss lending operations to the UK.

This is good news, but Shell needs to go much further. The graph below gives a prognosis of how much of Shell’s $39.9 billion profits could be registered in tax havens based on 2021 figures. Shell moved its headquarters from the Netherlands to the UK in 2021, so it is likely that there will be less profit booked in the Netherlands and more in the UK in 2022. Shell will also likely not be able to take advantage of the Netherland’s tax regime for liquidation losses(opens in new window) for head offices anymore to cut its tax bill. However, since Shell is paying UK income tax for the first time(opens in new window) in 2022 since 2017, it remains to be seen how much this move to the UK will increase the company’s tax bill.

Based on Shell’s consistent use of tax havens over the past four years, it is more than possible that Shell will also have registered large parts of its 2022 record profits in tax havens, and been able to generate such high profits thanks, in part, to its use of low-tax jurisdictions.

All to the benefit of the company’s shareholders, to which it distributed a total of $26 billion(opens in new window)

in 2022 after increasing dividends by another 15% in the final quarter. Meanwhile, people across the globe are suffering from rising energy prices and inflation.

In 2022, various European countries introduced windfall taxes, to limit their losses incurred by high energy prices. These taxes – also dubbed the ‘solidarity contribution’ – were aimed at taxing excess profits made by oil and gas companies due to high energy prices brought about by the war in Ukraine. In practice, energy companies’ subsidiaries in the EU were made subject to a 33% additional tax on any profits that exceeded their previous four years’ average profits by 20%.

With Shell’s global profit doubling to $40 billion in 2022 from the previous year, its windfall profits are unmistakeable. Yet, the company reports paying a mere $520 million(opens in new window) in EU windfall taxes in 2022, and $134 million in the UK, despite its nearly $20 billion in additional profits. Although much of Shell’s profits are likely to be generated outside the EU and UK, this roughly 3.3% percent additional tax seems to fail to address the massive profits Shell made in 2022. As such, the EU’s windfall taxes appear to fall short.

And although it is impossible to determine the effect Shell’s presence in tax havens had on the allocation of its windfall profits, it is plausible that the windfall profits tax’s effectiveness was limited by profits being shifted to tax havens. To ensure this does not take place Shell needs to immediately end its use of tax havens and pay its full, fair share in taxes. Furthermore, to effectively tax oil and gas companies’ windfall profits brought about by the war in Ukraine, the EU and UK must review their current windfall profits.

Shell’s profits and tax paid in selected tax havens, 2018-2021

Figures taken from Shell’s Tax Contribution Reports 2018-2021.

The Bahamas

Shell operates its West Africa and Latin American trading office from the Bahamas. The company had 35 employees in the Bahamas in 2021.

| The Bahamas | ||

| Pre-tax profit | 2018 | $971.887.531 |

| Tax paid | 2018 | $0 |

| ETR* | 0% | |

| Pre-tax profit | 2019 | $847.554.138 |

| Tax paid | 2019 | $0 |

| ETR | 0% | |

| Pre-tax profit | 2020 | $652.624.659 |

| Tax paid | 2020 | $0 |

| ETR | 0% | |

| Pre-tax profit | 2021 | $571.440.737 |

| Tax paid | 2021 | $0 |

| ETR | 0% | |

| Pre-tax profit | Average per year | $760.876.766 |

| Tax paid | Average per year | $0 |

| ETR | Average per year | 0% |

* Effective Tax Rate

Singapore

Shell employed 3,617 staff in Singapore in 2021, running a large oil refinery as well as retail sites. The tax haven is also the base for Shell’s regional Asia-Pacific treasury operations (including group lending entities), pension fund management, as well as trading business.

| Singapore | ||

| Pre-tax profit | 2018 | $2.135.392.026 |

| Tax paid | 2018 | $8.385.604 |

| ETR | 0% | |

| Pre-tax profit | 2019 | $2.294.675.686 |

| Tax paid | 2019 | $49.846.931 |

| ETR | 2% | |

| Pre-tax profit | 2020 | $1.134.633.728 |

| Tax paid | 2020 | $12.768.336 |

| ETR | 1% | |

| Pre-tax profit | 2021 | $937.089.191 |

| Tax paid | 2021 | $30.962.038 |

| ETR | 3% | |

| Pre-tax profit | Average per year | $1.625.447.658 |

| Tax paid | Average per year | $25.490.727 |

| ETR | Average per year | 2% |

Switzerland

Shell employed 111 staff in Switzerland in 2021. It has registered 15,000 of its trademarks in a corporate entity in the Swiss canton of Zug, which licenses these trademarks and receives royalty payments. In addition to trademark licensing, Switzerland is also the location of Shell’s principal insurance company. In 2019 Shell ended its intragroup lending activities in Switzerland.

| Switzerland | ||

| Pre-tax profit | 2018 | $1.412.499.471 |

| Tax paid | 2018 | $190.610.005 |

| ETR | 13% | |

| Pre-tax profit | 2019 | $2.453.477.961 |

| Tax paid | 2019 | $212.908.458 |

| ETR | 9% | |

| Pre-tax profit | 2020 | $1.589.909.851 |

| Tax paid | 2020 | $134.206.904 |

| ETR | 8% | |

| Pre-tax profit | 2021 | $1.145.042.331 |

| Tax paid | 2021 | $175.616.683 |

| ETR | 15% | |

| Pre-tax profit | Average per year | $1.650.232.403 |

| Tax paid | Average per year | $178.335.512 |

| ETR | Average per year | 11% |

United Arab Emirates

Shell had 351 employees in the UAE in 2021. It operates petroleum ventures in the country, but the UAE also serves as a regional hub for service provision and trading.

| United Arab Emirates | ||

| Pre-tax profit | 2018 | $1.522.265.384 |

| Tax paid | 2018 | $346.849.575 |

| ETR | 23% | |

| Pre-tax profit | 2019 | $2.948.376.930 |

| Tax paid | 2019 | $172.036.915 |

| ETR | 6% | |

| Pre-tax profit | 2020 | $704.556.791 |

| Tax paid | 2020 | $50.010.445 |

| ETR | 7% | |

| Pre-tax profit | 2021 | $442.320.134 |

| Tax paid | 2021 | $168.760.848 |

| ETR | 38% | |

| Pre-tax profit | Average per year | $1.404.379.810 |

| Tax paid | Average per year | $184.414.446 |

| ETR | Average per year | 13% |

The Netherlands

Shell had 8,103 employees in The Netherlands in 2021, operating a refinery and gas extraction. However, The Netherlands is also a centre for trading, holding and treasury activities.

| Netherlands | ||

| Pre-tax profit | 2018 | $3.733.780.266 |

| Tax paid | 2018 | $173.557.292 |

| ETR | 5% | |

| Pre-tax profit | 2019 | $2.858.971.610 |

| Tax paid | 2019 | $212.039.855 |

| ETR | 7% | |

| Pre-tax profit | 2020 | $(2.189.336.090) |

| Tax paid | 2020 | $106.930.390 |

| ETR | n/a | |

| Pre-tax profit | 2021 | $2.200.418.515 |

| Tax paid | 2021 | $165.023.107 |

| ETR | 7% | |

| Pre-tax profit | Average per year | $1.650.958.575 |

| Tax paid | Average per year | $164.387.661 |

| ETR | Average per year | 10% |

Bermuda

In 2020 Shell ceased its lending activities in Bermuda. It had 3 employees in 2019.

| Bermuda | ||

| Pre-tax profit | 2018 | $683.036.942 |

| Tax paid | 2018 | $12.500.000 |

| ETR | 2% | |

| Pre-tax profit | 2019 | $594.996.797 |

| Tax paid | 2019 | $76.937.000 |

| ETR | 13% | |

| Pre-tax profit | 2020 | $36.085.318 |

| Tax paid | 2020 | $0 |

| ETR | 0% | |

| Pre-tax profit | 2021 | $(5.901.995) |

| Tax paid | 2021 | $0 |

| ETR | 0% |

Do you need more information?

-

Jasper van Teeffelen

Researcher

Related content

-

New UK legal case on Niger Delta oil spills – a litmus test for justice in the energy transitionPosted in category:Opinion

Audrey GaughranPublished on:

Audrey GaughranPublished on: Audrey Gaughran

Audrey Gaughran -

The Shell climate verdict: a major win for mandatory due diligence and corporate accountabilityPosted in category:Opinion

Joseph Wilde-RamsingPublished on:

Joseph Wilde-RamsingPublished on: Joseph Wilde-Ramsing

Joseph Wilde-Ramsing -

Quick profits, lasting damagesPosted in category:Opinion

Ilona HartliefPublished on:

Ilona HartliefPublished on: Ilona Hartlief

Ilona Hartlief -

Moderna vaccine profits channelled to tax havensPosted in category:News

Moderna vaccine profits channelled to tax havensPosted in category:News Vincent KiezebrinkPublished on:

Vincent KiezebrinkPublished on: -

-

European tax havens help Ukrainian poultry giant to feather its nestPosted in category:News

European tax havens help Ukrainian poultry giant to feather its nestPosted in category:News Vincent KiezebrinkPublished on:

Vincent KiezebrinkPublished on: -

How tax havens like the Netherlands are draining developing countries of precious public fundsPosted in category:Opinion

Maarten HietlandPublished on:

Maarten HietlandPublished on: Maarten Hietland

Maarten Hietland -

First-ever OECD complaint on tax avoidance filed against Chevron’s shell companiesPosted in category:NewsPublished on:

First-ever OECD complaint on tax avoidance filed against Chevron’s shell companiesPosted in category:NewsPublished on: