Ready to Roomba

The iRobot Amazon merger

Today SOMO, Foxglove(opens in new window) , the Balanced Economy Project(opens in new window) and the Open Markets Institute(opens in new window) have to the European Commission’s competition department (DG Competition) to ask for a full investigation into Amazon’s planned acquisition of vacuum robot maker, iRobot. Amazon is trying to buy its way into our homes and make the iRobot’s Roomba the latest addition to its sprawling home data collection devices. The merger threatens to give the tech giant eyes inside our homes and further entrench its market dominance.

Vacuuming up domestic data

Amazon and iRobot announced(opens in new window) they had come into a merger agreement on 5 August 2022. The deal would see Amazon taking over the maker of the Roomba vacuum robot iRobot for 61 dollars per share in an all-cash transaction valued at approximately 1.7 billion dollars.

iRobot is most famous for its eternally memeable(opens in new window) vacuum cleaner, the Roomba. The Roomba doesn’t just vacuum up dirt though: newer models include an array of sensors and even cameras that allow the vacuum to map and record house floors and overcome obstacles. Using automated systems, the Roomba can process the information collected to see inside peoples’ homes. The information Roombas capture can be incredibly sensitive as was shown recently when pictures of children playing and a woman on the toilet taken from a Roomba were leaked(opens in new window) to social media by a third party data labelling company.

Amazon, while mostly famous for its ecommerce arm, has also been steadily investing (mostly via buyouts) in home connected devices. It now holds a sprawling home data collection empire that includes the personal assistant Alexa, smart speakers Echo, doorbell and security devices Ring. Much of Amazon’s advances in this area were achieved via mergers(opens in new window) : in 2017 Amazon bought video doorbell company Blink, in 2018 home security Ring and in 2019 wifi router maker, Eero.

According to the Washington Post(opens in new window) , “No other Big Tech company reaches deeper into domestic life”. The strategy from Amazon executives, as unveiled(opens in new window) by the House Judiciary investigation into digital markets, stressed that “Two senses matter- eyes and ears”.

If allowed to go ahead, the acquisition of iRobot would give Amazon eyes inside our homes.

Buying its own into dominance

Amazon has been expanding its European presence for the past twenty years. Its retail business (Amazon EU S.a.r.l(opens in new window) ) alone reported 51.3 billion euros in revenue across Europe in 2021. Amazon’s market reach in Europe is immense. In Germany, it is estimated(opens in new window) that 1 in every 2 euros spent online was spent on Amazon. EU competition authorities (including DG Competition) have found Amazon to be dominant in Italy(opens in new window) , Germany(opens in new window) and France(opens in new window) . The ecommerce giant is also quickly expanding its advertising(opens in new window) and cloud services(opens in new window) arms.

The Roomba maker, on the other hand, is the leading producer of connected vacuum cleaners. The company itself estimates(opens in new window) it holds 53% of the global (excluding China) market for high-end vacuum cleaners, and 43% in Europe, Middle East and Africa (EMEA). iRobot has a strong presence in Europe with subsidiaries established in France, Belgium, Portugal, Austria, Germany, Spain, Italy, and the Netherlands. In 2020, the company declared a combined revenue of 163.9 million euros in Germany, France and Spain.

| 2020 | 2019 | ||

| iRobot Germany(opens in new window) | EUR 41,553,047 | EUR 93,976,314 | |

| iRobot France(opens in new window) | EUR 69,736,000 | EUR 66,691,000 | |

| iRobot Spain(opens in new window) | EUR 52,563,873 | EUR 50,045,016 | |

| Total | EUR 163,854,940 | EUR 210,712,330 |

It is not difficult to imagine how iRobot’s home data could be used by Amazon to build user profiles for personalised advertising and other services. It could also give the company an advantage in developing new products. This is a market power problem.

Amazon’s strategy to buy dominance and ensure consumers are forever stuck on its orbit is by now well-known. Jeff Bezos himself has famously coined the company’s spinning flywheel(opens in new window) strategy which states that momentum given to one strand of the business will also boost the others, creating a self-reinforcing cycle. When acquiring Ring, the then CEO also explained(opens in new window) that Amazon’s interest was market position “as it’s hard to catch the leader”.

This dominance comes at the expense of users and smaller businesses. This is already visible in the home connected devices market as a preliminary report from the European Commission showed(opens in new window) :

“ (…) a large number of respondents consider the main obstacle to developing new products and services to be the inability to compete with Google, Amazon and Apple. This is because these vertically integrated companies have built their own ecosystems within and beyond the consumer IoT [Internet of Things] sector by combining their own and integrating third-party products and services into an offering with a large number of users.”

EU Commission must investigate

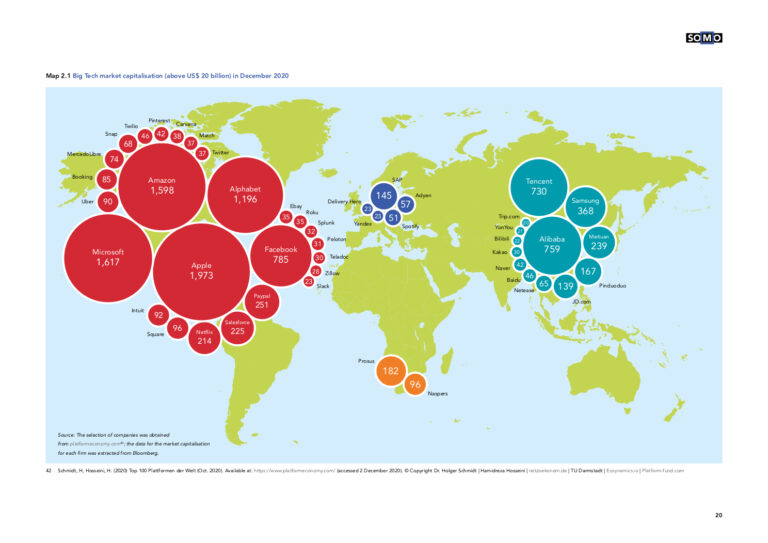

So far, the EU has mostly waved through Big Tech’s mergers. From the over 1000 acquisitions made by US Big Tech firms in just a decade, the EU has only investigated a few and blocked none. Concerning mergers such as Google’s buying of Fitbit and Facebook’s buying of Whatsapp were authorised with only a few behavioural safeguards put in place. Yet, these are often hard to monitor or to enforce and, ultimately, don’t root out the problem: the monopoly power of Big Tech.

The lack of action from competition authorities across the world, and in the EU, when it came to mergers and acquisitions have allowed Big Tech to pursue a monopolisation strategy. Big Tech firms like Amazon now wield such power that they can set the rules for users, competitors, workers and small businesses.

That is why we now ask the EU’s DG Competition to be bold and go beyond the approach taken so far by conducting a full investigation into Amazon’s proposed merger with iRobot, in coordination with data protection authorities, and seriously consider blocking the deal.

Do you need more information?

-

Margarida Silva

Researcher

Partners

-

Balanced Economy Project

-

Foxglove

-

Open Markets Institute

Related content

-

The EU should not give in to Amazon’s weak commitments, civil society organisations sayPosted in category:Opinion

Margarida SilvaPublished on:

Margarida SilvaPublished on: Margarida Silva

Margarida Silva -

COVID-19 pandemic accelerates the monopoly position of Big Tech companiesPosted in category:News

COVID-19 pandemic accelerates the monopoly position of Big Tech companiesPosted in category:News Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: -

The financialisation of Big Tech Published on:

Rodrigo FernandezPosted in category:Publication

Rodrigo FernandezPosted in category:Publication Rodrigo Fernandez

Rodrigo Fernandez

-

How Big Tech is becoming the GovernmentPosted in category:Opinion

Rodrigo FernandezPublished on:

Rodrigo FernandezPublished on: Rodrigo Fernandez

Rodrigo Fernandez