The limitations of the UNCITRAL process on ISDS reform

The UNCITRAL process runs a real risk of producing middle-ground solutions that will fail to address the fundamental flaws of the ISDS system and will only further institutionalise and re-legitimise the system. Read this blog written by Bart-Jaap Verbeek:

Between 29 October and 2 November 2018, the members of Working Group III of the United Nations Commission on International Trade Law (UNCITRAL) are coming together in Vienna to continue with discussions on a possible reform of the investor-to-state dispute settlement (ISDS) mechanism. The UNCITRAL process could offer an unique opportunity to thoroughly examine the widely recognised problems with ISDS and to meaningfully address its systemic imbalances. However, the process is, to a large extent, driven by the same institutions and individuals that share a common interest in the long-term survival of the system. The UNCITRAL process thus runs a real risk of producing middle-ground solutions that will fail to address the fundamental flaws of the ISDS system and will only further institutionalise and re-legitimise the system. Such an outcome would be most unfortunate, at a time when ISDS is losing political support all over the world, and a growing number of countries is signalling a desire to move away from the current model of treaty-based investment protection.

Building pressures for reform

ISDS has become a controversial issue in recent years, not least because of the growing opposition from trade unions, farmers, small and medium enterprises, environmental groups, human rights and consumer groups, academics and judges. The ISDS system, incorporated in many of today’s international trade and investment agreements, gives sweeping powers to corporations to sue governments before private arbitral tribunals consisting of three private lawyers, and to claim dazzling amounts in compensation for the introduction of new regulations, including those that are non-discriminatory, legitimate and in the public interest. Many of today’s corporations are equal to states in terms of their economic size, which allows them to bring claims that can seriously impact on public budgets. Even a threat of ISDS claims can persuade countries to shy away from introducing new regulations or tightening existing rules that find fault with transnational corporate industry. ISDS as a means to enforce far-reaching investment protections gives corporations a powerful tool to exert political influence and thus serves to further exacerbate the escalating power imbalance between transnational capital on the one hand, and governments and citizens on the other.

Many governments, in particular of countries who have been on the receiving end of ISDS claims, have begun to question the global investment treaty regime. Growing discontent with the ISDS straitjacket has made governments from countries as diverse as Ecuador, India, Indonesia, South Africa, Uganda, Tanzania and Venezuela decide to terminate many of their investment treaties that include ISDS. Even the US, Mexico and Canada, in their renegotiation of NAFTA, recently agreed to roll back ISDS(opens in new window) . These moves were spurred not least because evaluations show that evidence that signing such agreements will indeed bring more foreign investment is at the very least inconclusive, yet bring significant risks to the policy space of states. Brazil, for example, never ratified any investment treaties with ISDS, yet remains one of the world’s top-recipients of foreign investment. Business will move where it sees opportunities for profit, and an investment treaty offering extra insurance in the form of ISDS is but an added bonus.

A spotlight on the UNCITRAL process on ISDS reform

Against this backdrop, UNCITRAL entrusted one of its working groups with a mandate to work on the possible reform of ISDS in July 2017. Working Group III would proceed to: first, identify and consider concerns regarding ISDS; second, consider whether reform was desirable in the light of any identified concerns; and third, if the Working Group were to conclude that reform was desirable, develop any relevant solutions.

It is at UNCITRAL that, in response to the mounting criticism to ISDS, the European Union has begun pushing(opens in new window) for the creation of a Multilateral Investment Court (MIC). In the EU’s proposals, such a court will bring some procedural improvements, but otherwise leave the main principles and systemic flaws of ISDS intact(opens in new window) .

At UNCITRAL, the scope for a more radical reform of ISDS, let alone the substantive overhaul of the global investment treaty regime that many critical voices feel is required, is limited, because of the particular set-up of the responsible working group, as well as the continuing dominance of the process by the vested interests in investment arbitration. First, UNCITRAL is an institution deeply in the ISDS system. Second, the mandate underscores UNCITRAL’s consensus-driven process, meaning that the Working Group is very likely to produce, at best, a weak compromise between the on ISDS.

These limitations are clearly reflected in the approach of the Working Group. The current agenda(opens in new window) remains limited to procedural issues related to concerns that stem from the lack of consistency, coherence, and predictability; impartiality and independence of arbitrators; and cost and duration of ISDS cases. For the upcoming session in Vienna, the secretariat prepared a list of possible solutions(opens in new window) to be considered by the members of the Working Group. These include better guidance mechanisms to arbitral tribunals, code of conduct for arbitrators, the creation of a roster with tenured judges, the introduction of an appellate body or a fully-fledged international court system, an advisory centre that would assist governments in ISDS proceedings, and rules on third-party funding. These possible solutions would only further entrench and institutionalise ISDS and leave the structural problems and injustices that the system produces intact. Limiting the highly problematic, broadly interpretable protections that ISDS enforces is not on the agenda.

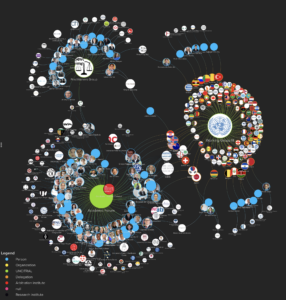

Click on the image below to see the social mapping of the UNCITRAL process on ISDS reform.

(opens in new window)

Photo: SOMO

(opens in new window)

Photo: SOMOLetting the foxes guard the henhouse?

Highly problematic is the overt presence of many practitioners and lobby groups in the Working Group. Several private arbitrators and lawyers participate in the official government delegations. The mandate(opens in new window) particularly stresses that “the deliberations, while benefiting from the widest possible breadth of available expertise from all stakeholders, would be Government-led”. Yet, when looking at the of the 35th session of Working Group III in New York, at least 20 of the 88 delegations included non-governmental lawyers and academics with experience in ISDS either as an arbitrator, counsel or expert witness.

Furthermore, the vast majority (85%) of participating as an observer in the first two sessions of Working Group III is directly or indirectly linked to the private arbitration industry (or broader transnational business interests), with only 14% representing wider public interests. This contradicts the explicit objective(opens in new window) of UNCITRAL of achieving “a balanced representation at the sessions of the major viewpoints or interests” with regard to ISDS. Particularly worrisome is the rejection of some civil society groups(opens in new window) on the basis of arguments that they would not be bringing sufficient unique experience. Such reasoning seems perversely arbitrary in the light of the many invited groups and individuals that exclusively represent the singular perspective of the private arbitration industry.

The grip of the arbitration industry also stretches beyond the confines of the Working Group. Most of the input into the UNCITRAL process seems to originate from individuals and organisations that are linked to ISDS and have clear stakes in its long-term survival. Notably, two expert groups are closely linked to the UNCITRAL process and play a crucial role in framing the problems with ISDS reform and hence in shaping the contours of the discussions. First, an academic forum(opens in new window) was set up as a ‘think tank’ to study the desirability of reform and examine possible options. The driving force behind the forum is the Geneva Center for International Dispute Settlement (CIDS). CIDS is run by one of the busiest ISDS arbitrators(opens in new window) , and was involved in laying the groundwork for future discussions at a very early stage, when it prepared, for UNCITRAL, two reports(opens in new window) to explore possible avenues for ISDS reform. In terms of membership(opens in new window) , the academic forum consists of 103 individuals, many of whom are directly connected with the ISDS system: at least 26 members have acted as arbitrator(opens in new window) in ISDS, and many more as counsel or expert witness.

Second, a practitioners group(opens in new window) was set up with the purpose to provide ISDS lawyers with a forum to “make constructive contributions to the ongoing discussions on possible reform of ISDS”. This group consists exclusively of 32 lawyers from the most renowned law firms specialised in ISDS, who, as such, have an undeniable stake in the perpetuation of the system.

Towards a substantive reform of ISDS

Today, over 300 civil society groups (including SOMO) and trade unions from around the world sent a public letter urging governments participating in the UNCITRAL meetings to fight for the much needed substantive reform of the ISDS system. The signatory organisations call on governments to concentrate on the structural problems with ISDS and to explore options to move away from the current investment treaty regime altogether: procedural tweaks will not fix, but only further entrench and institutionalise what is a fundamentally flawed system. The radical approach would be to break away from sweeping treaty-based investment arbitration altogether and work towards a multilateral approach to eliminate ISDS(opens in new window) .

Approaches to address some of the widely recognised problems from within the system might include:

- Requiring investors to exhaust local remedies;

- Allowing states to bring counterclaims;

- Dismissing claims against decisions to protect the public interest;

- Denying access to ISDS for investors that violate domestic or international obligations in relation to human rights, environmental protection or climate objectives;

- Allowing affected communities and individuals to join a case with full rights.

Do you need more information?

-

Bart-Jaap Verbeek

Researcher

Related content

-

Civil society organizations urge fundamental reform at UNCITRAL’s ISDS discussionsPosted in category:Published on:Statement

-

ISDS reform: The need for a substantive overhaul to investment protectionPosted in category:Opinion

Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on: Bart-Jaap Verbeek

Bart-Jaap Verbeek -

How are things with ISDS? This week at the UN in New York.Posted in category:News

How are things with ISDS? This week at the UN in New York.Posted in category:News Bart-Jaap VerbeekPublished on:

Bart-Jaap VerbeekPublished on: -

Same old, same old: the EU pushes ISDS 2.0Posted in category:NewsRoeline KnottnerusPublished on:

Same old, same old: the EU pushes ISDS 2.0Posted in category:NewsRoeline KnottnerusPublished on: