Big Companies, Low Rates

A study of the effective tax rates of large Dutch companies

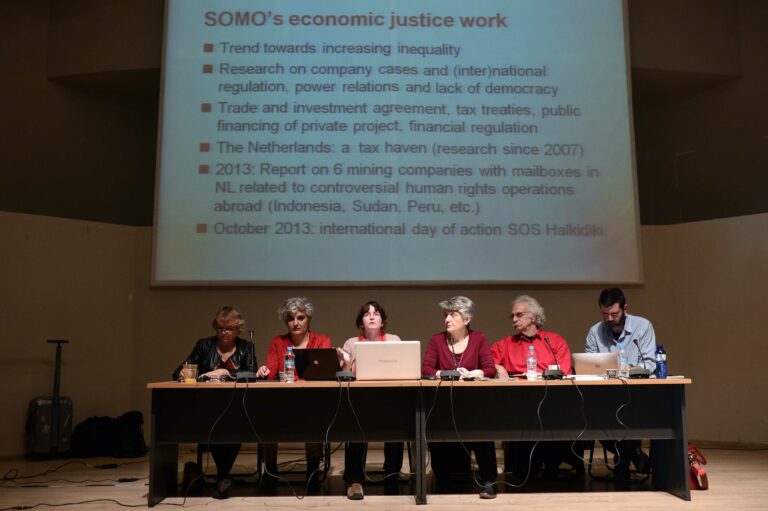

The paper Big Companies, Low Rates is a summary of the Dutch report “Grote Bedrijven, Kleine Lasten”. Commissioned by FNV, SOMO examined the average, effective tax rate for a group of more than 150 large Dutch companies over a period of ten years (2005-2014). The report focuses on a group of Dutch companies and the degree to which they have succeeded in reducing their effective tax rates.

The statutory tax rate for corporate income – the legally-prescribed tax rate that is used for taxation of company profits – decreased in the last ten years from 31.5 per cent in 2005 to 25 per cent in 2014. The effective tax rate shows to what extent companies are able to effectively lower this rate through, amongst other things, tax avoidance.

In the report 93 publically listed companies and 58 non-listed companies were researched. The average effective tax rate of those listed companies amounted to 21.5 per cent in the period 2005-2014. The company profits of the non-listed companies only large family-owned companies and cooperatives were included in this research were effectively taxed at a rate of 17,9 per cent. This is lower than the average statutory rate over this same period, which leads to a loss in tax revenues for governments of € 3 billion per year.

The research also identifies indicators for the use of avoidance strategies. Download also the Research Methodology.

Do you need more information?

-

Vincent Kiezebrink

Researcher

Publication

Related content

-

Crisis-ridden Greece hit by tax avoidance through the NetherlandsPosted in category:NewsPublished on:

Crisis-ridden Greece hit by tax avoidance through the NetherlandsPosted in category:NewsPublished on: -

-

-

-

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on:

The Netherlands lags further behind in tackling tax avoidancePosted in category:NewsPublished on: -